- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Value-Based Payment Models in Oncology: Will They Help or Hinder Patient Access to New Treatments?

The Deloitte Center for Health Solutions recently interviewed individuals from health plans, providers, and clinical pathway developers that are participating, supporting, or evaluating oncology payment models to understand what approaches are perceived to be working, the early results, and the potential impact on innovation.

Introduction

The costs of treating cancer are rising—approximately $124.6 billion in 2010 in the United States and projected to grow to $158 billion to $173 billion by 2020.1 Increased spending on cancer care can be attributed to a number of factors, including an aging population, growth in the number of individuals with insurance coverage, earlier diagnoses, and longer survival rates. We have also made advances in surgeries, radiation therapies, and medications—including advanced immunotherapies and targeted therapeutics. But these advancements are paralleled with rising treatment costs.

Today, many health plans, health systems, and oncology groups have begun experimenting with value-based payment models to control rising costs, reduce unexplained variation in care, and improve patient outcomes. Four value-based payment models are being tested in the commercial market:

1. Financial incentives for adhering to clinical pathways

2. Patient-centered medical homes (PCMHs)

3. Bundled payments

4. Specialty accountable care organizations (ACOs).

In addition, CMS recently launched the Oncology Care Model (OCM), a 2-part payment system, resembling a PCMH and a bundled payment model. Many of these models target drug spending.

The Deloitte Center for Health Solutions recently interviewed 18 individuals from health plans, provider groups, and clinical pathway developers that are participating, supporting, or evaluating oncology payment models to understand what approaches are perceived to be working, and what the early results (financial and clinical) have been. We also sought to understand how these payment models affect the use of new treatments. With rapid advances in diagnostics, precision medicine, and immunotherapy, how can a standardized payment model be defined that leaves room for innovation? Our research revealed that many organizations are experimenting with value- based payment models that aim to balance the competing goals of controlling costs and allowing access to advances in treatment. While none of the participating organizations claimed to have solved this equation, all of them indicated that they had seen early signs of success and were working to evolve and expand these models.

How Do Value-based Payment Models Influence Drug Use and Spending?

Value-based payment models can influence prescribing primarily through 2 mechanisms:

1. Using evidence-based clinical pathways to provide decision- making support

2. Including drug costs as part of bundled payment models, including the OCM.

Clinical pathways.

All the providers we interviewed were implementing clinical pathways to steer prescribers to the most cost-effective drug treatments, regardless of payment model participation. These providers were evaluating compliance with evidence-based pathways to find opportunities for savings on drug spending. Implementing a clinical pathway tool is typically among the first steps for providers participating in any of the payment models we evaluated.

Both health plans and physician practices can develop and administer clinical pathways. Either way, prescribers are held to a goal of adhering to pathways 70% to 85% of the time, allowing for some flexibility for variability in care that might result from patient characteristics, preferences, or the introduction of new treatments.

Among the physicians we interviewed, on- or off-pathway status influenced their prescribing patterns, especially when pathway status was directly tied to reimbursement. Off-pathway drugs might require additional prior authorization, which creates administrative burdens for providers who choose those drugs. Some physicians we interviewed expressed resistance to adopting pathways, because they did not want to be in a situation where they could not treat a patient with a novel therapy that is not yet on an approved clinical pathway. More frequent updates to clinical pathways could reduce delays in adopting new therapies.

Bundled payments.

The cost of drugs is calculated directly into reimbursement for the majority of bundled payment models being piloted. Participants in these programs told us that their bundles varied from covering the cost of 1 service, to covering all services over a 1-month or up to a 2-year time frame (Figure 1). Almost everyone interviewed participating in a bundled payment model included drug treatment as part of the bundle, though most providers were not taking on downside risk.

Several health plans said they were experimenting with different approaches to allow flexibility for providers using expensive new treatments. These approaches include precisely defining bundles based on cancer stage and biomarker status, adjusting bundle prices frequently, carving-out new treatments, and incorporating a stop-loss provision to reduce financial risk to the provider after spending hits a certain threshold.

Other health plan leaders and providers we interviewed were strongly opposed to bundled payments for oncology. These interviewees expressed concern about the underlying complexities of standardizing a bundle for a disease where variation is normal, due to patient and disease characteristics, particularly when patient volumes for any particular bundle are low. Furthermore, they were worried about the unpredictability of drug costs, especially given the recent pace of innovative new drugs entering the market. One health system leader was concerned that a bundled payment model could force physicians in his organization to decide about using a new treatment based on financial constraints.

OCM.

The risk-sharing component of CMS’s OCM is initiated at the start of chemotherapy, and includes the costs for chemotherapy and other services for 6 months. Organizations participating in the OCM started with a 1-sided risk arrangement, and were allowed to take on 2-sided risk starting January 1, 2017. Under the Medicare Access and [Children’s Health Insurance Program] CHIP authorization Act (MACRA), clinicians participating in advanced alternative payment models (APMs), including OCM with 2-sided risk, will receive a 5% increase in their Medicare payments. This increase would be in addition to potential shared savings or performance bonuses that APMs may produce. Those we interviewed expressed an interest in eventually moving towards 2-sided risk arrangements so they can take advantage of these financial incentives. MACRA could spur additional interest from providers in participating in this payment model.

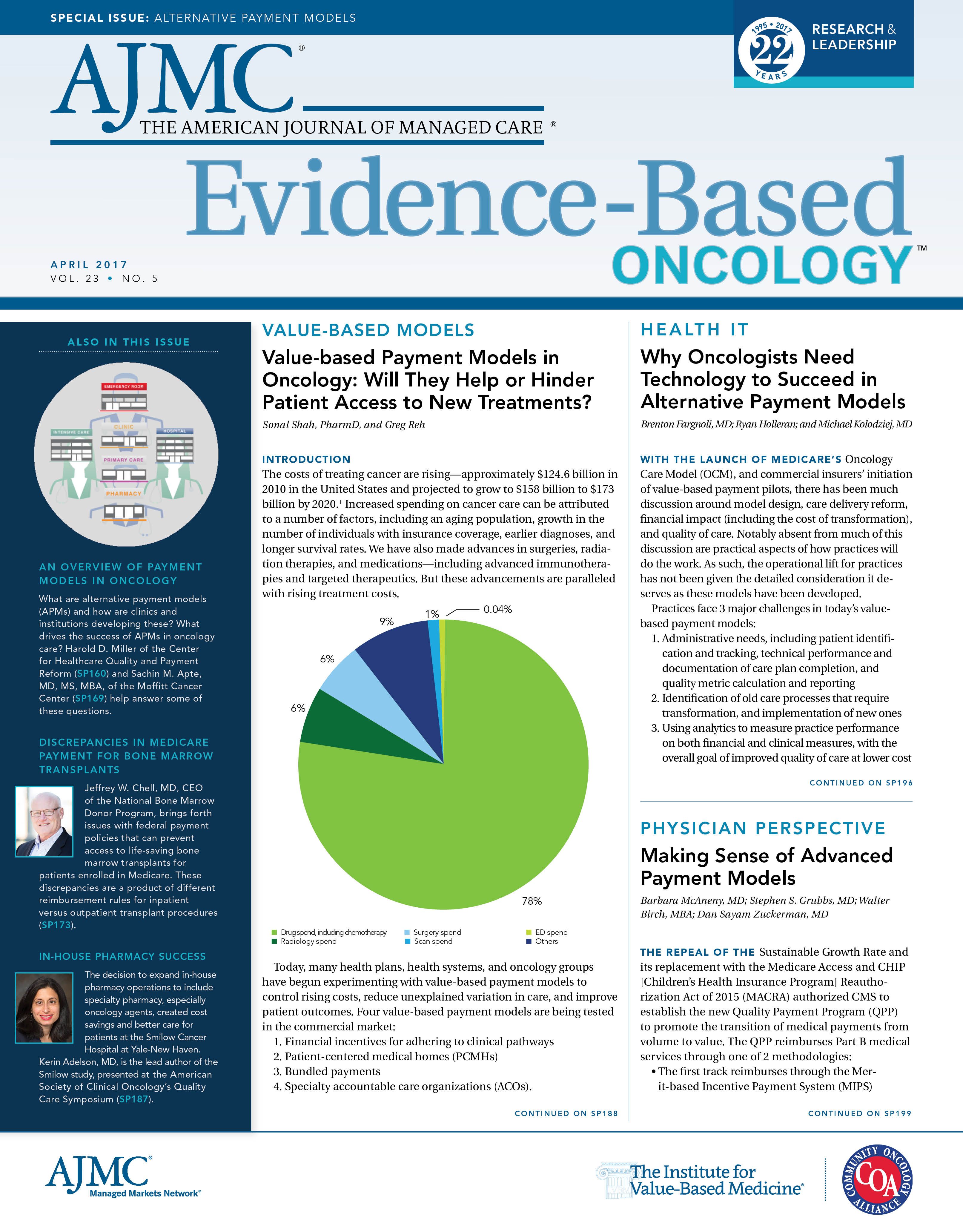

The increased interest in OCM is important to highlight since the majority of savings across the measured 6-month period is expected to come from drug spending. We analyzed 2013-2014 Truven MarketScan2 commercial claims data for stage I breast cancer patients to identify spending (defined as the total claims paid by commercial insurers) variance across major service areas. Claims were categorized into episodes, including all services over a 6-month period and initiated by chemotherapy, mimicking the definition of an OCM episode. The primary focus was on patients with stage I disease, since this early stage is least likely to be associated with significant clinical variation and associated variability in spending.

For the 1385 identified episodes of cancer, the average spending per episode was $30,000—the range was $500 to $200,000. A majority of spending was on drugs, including all drugs prescribed and administered in the inpatient or outpatient setting, with retail and over-the-counter drugs were excluded (Figure 2). Further, most of the variability in cost across the total episode comes from drug spending, followed by surgery, and radiology (Figure 3).

What Have Been the Financial Savings From These Payment Models?

Many new payment models have shown some early, but varied, success in reducing the cost of cancer care (Table). Most of those interviewed attribute this success to a combination of elements: more efficient use of evidence-based pathways, increased access to lower-cost care settings, reduced need for managing patients in the emergency department or in-patient facilities, and proactive care planning. Notably, all those interviewed suggested that the use of clinical pathways was a driver of financial savings, either directly through reduced drug spending or indirectly through more appropriate patient treatment.

Will New Value-based Payment Models Pose Challenges for Adoption of New Treatments?

Currently, the impact of value-based payment models on new treatments is unclear. The implementation of evidence-based pathways as part of value-based payment models could, in some instances, increase the use of new treatments. On the other hand, payment models that emphasize financial goals could deter physicians from prescribing expensive therapies.

Quality measures included in new payment models may also drive prescribing behavior. Short-term measures or those with a narrow focus could make it difficult to recognize and reward the value that new treatments may offer. Without a way to capture this benefit, physicians may choose to avoid costly treatments in an attempt to meet financial metrics. As payment models evolve, quality measures should reflect the value of innovation and focus on things that matter most to patients.

Diagnostics will likely become increasingly valuable in cancer care as our understanding of tumor adaptation and drug targets continues to expand. The applications of diagnostics are rapidly expanding beyond simply determining appropriate use of individual targeted therapies. Genomic testing, immuno-sequencing, and other diagnostics can determine the profile of a patient’s cancer and identify a set of treatment options that patients are most likely to respond to. New treatments, including immunotherapies, which harness the patient’s immune system to identify and attack cancer cells, may become more tailored and targeted to address mutations in cancers resistant to other treatments. In the near-term, these advances in diagnostics and treatment may continue to increase spending in oncology. However, in the future, dynamic clinicaldecision support tools that consider multiple patient variables and also consider the financial trade-offs of treatment choices can help direct prescribers to treatments that can optimize patient outcomes and reduce cost over the long term.

Conclusions

Early experiments with value-based payment models show some promise, and as providers invest in data, analytics, and patient-centered care, their willingness to participate in value-based payment models is likely to expand. Investments in data analytics may help providers identify opportunities to reduce variability in cost and outcomes, increasing their comfort in accepting downside risk. However, as payment models evolve they should incorporate quality measures that capture the value that new treatments can bring so that financial incentives alone do not drive prescribing.

Many stakeholders across the ecosystem are investing in new technologies such as artificial intelligence and blockchain to help illuminate which drugs work in specific patient populations, and under what circumstances. Access to such information could guide the use of new drugs and treatments, improve health outcomes, and reduce spending.

FUNDING SOURCE:

None.

Sonal Shah, PharmD, is a senior manager at the Deloitte Center for Health Solutions, where she leads research projects on emerging trends, challenges, and opportunities in healthcare. Dr Shah’s research is focused on research and development and innovation, value-based care, and the impact of healthcare reform to life sciences companies.

Greg Reh leads the global and US life sciences practices for Deloitte. Greg has more than 25 years of experience helping clients in the life sciences, process manufacturing, consumer, and government sectors. In his role consulting to clients, his career has spanned such topics as technology strategy, integration solution development, and implementation of emerging and disruptive technology.

ADDRESS FOR CORRESPONDENCE

Greg Reh

1700 Market Street

Philadelphia, PA 19103

E-mail: grreh@deloitte.com

DISCLAIMER

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

REFERENCES

1. Cancer costs projected to reach at least $158 billion in 2020 [press release]. Bethesda, MD: National Cancer Institute; January 12, 2011. https://www.nih.gov/news-events/news-releases/cancer-costsprojected- reach-least-158-billion-2020. Accessed February 9, 2017.

2. Data on file. Copyright 2014 Truven Health Analytics Inc., an IBM Company. All Rights Reserved.

3. Deloitte analysis of secondary literature and interview findings.

Ambient AI Tool Adoption in US Hospitals and Associated Factors

January 27th 2026Nearly two-thirds of hospitals using Epic have adopted ambient artificial intelligence (AI), with higher uptake among larger, not-for-profit hospitals and those with higher workload and stronger financial performance.

Read More

Exploring Racial, Ethnic Disparities in Cancer Care Prior Authorization Decisions

October 24th 2024On this episode of Managed Care Cast, we're talking with the author of a study published in the October 2024 issue of The American Journal of Managed Care® that explored prior authorization decisions in cancer care by race and ethnicity for commercially insured patients.

Listen

Motivating and Enabling Factors Supporting Targeted Improvements to Hospital-SNF Transitions

January 26th 2026Skilled nursing facilities (SNFs) with a high volume of referred patients with Alzheimer disease and related dementias may work harder to manage care transitions with less availability of resources that enable high-quality handoffs.

Read More