- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Predictors of and Barriers to Receipt of Advance Premium Tax Credits

Few eligible individuals apply for the Advance Premium Tax Credit due to knowledge barriers. Additionally, specific sociodemographic characteristics appear to predict applying status.

ABSTRACT

Objectives: The Advance Premium Tax Credit (APTC) is designed to remedy lack of health insurance due to cost; however, approximately 30 million Americans remain without health insurance and millions of households leave billions in tax credits unclaimed each year. A prerequisite of APTC is to file one’s taxes; however, few studies have examined tax filing and APTC jointly. This study examined the relationship between tax filing and applying for APTC, as well as perceived barriers to and sociodemographic characteristics associated with applying for the APTC.

Study Design: Descriptive study.

Methods: Researchers surveyed 372 Marketplace-insured members who were eligible for APTC.

Results: Most of the sample filed personal taxes in 2019 and planned to file taxes in 2020, yet only 23% applied for the APTC in 2019, and 26.3% were planning to apply in 2020. Most commonly, respondents were not going to apply because they believed they were not eligible (53.5%), they did not know about the APTC (15.8%), and they did not know whether they were eligible (9.9%). Logistic regression modeling found that employment, income, and race were significantly associated with applying for the APTC.

Conclusions: Barriers to applying for the APTC were unrelated to tax filing and were specific to a lack of knowledge about the APTC and eligibility. These results indicate the need to build knowledge and awareness of the APTC and eligibility and to target groups least likely to apply. Implications and future directions are discussed.

Am J Manag Care. 2022;28(11):594-599. https://doi.org/10.37765/ajmc.2022.89262

Takeaway Points

Thirty million Americans are currently without health insurance and billions of tax credits are unclaimed annually. Tax filing is a prerequisite to apply for the Advance Premium Tax Credit (APTC). This study examined the relationship between tax filing and the APTC, sociodemographic characteristics and barriers associated with applying for the APTC. Most of the sample filed their taxes, yet few applied for the APTC. Not having adequate knowledge about the APTC and eligibility requirements were barriers to applying. Additionally, employment, income, and race were associated with applying for the APTC.

- Barriers to applying for the APTC were unrelated to tax filing and were specific to a lack of knowledge about the APTC and eligibility.

- There is a need to build knowledge of the APTC and eligibility and to target groups least likely to apply.

- Raising awareness of and application to the APTC could be accomplished through coupling the APTC application process with tax filing assistance programs.

The Affordable Care Act (ACA) expanded insurance coverage to millions of Americans through the expansion of Medicaid coverage, the establishment of Marketplace health insurance exchanges, and cost-sharing subsidies for low- to moderate-income individuals.1 In an effort to make Marketplace insurance plans more affordable for households whose annual household income falls within 100% to 400% of the federal poverty level (FPL), the ACA introduced premium tax credits (PTCs) to subsidize monthly premium payments. The ACA allows for advanced payments of the PTC (Advance Premium Tax Credits, or APTCs) to certain members based on their estimated annual household income and other information reported on a standard Marketplace application. To be eligible, members must meet requirements related to income, tax filing status (cannot file a “married filing separately” tax return and cannot be claimed as a dependent), Marketplace enrollment duration (at least 1 month of the year), and other health insurance coverage options (cannot be eligible for other employer-sponsored coverage or Medicaid/Medicare).2

However, an astounding 30 million Americans still remain without health insurance more than a decade after the 2010 passage of the ACA, and up to 50% of uninsured individuals who qualify for subsidized health insurance coverage under the ACA live in poverty.3-6 Although the APTC is designed to remedy lack of health insurance due to cost, millions of households are leaving billions of dollars unclaimed each year.7 As a case in point, studies of a related tax credit, the Earned Income Tax Credit (EITC), which provides up to $6728 for qualifying low-income working households, indicate that the take-up rate is only around 80%.8

Tax filing behaviors may be partially responsible for why millions of dollars in tax credits such as the APTC remain unclaimed annually. To remain compliant with APTC requirements, recipients must file their taxes at the end of the tax filing period. All Marketplace members receive a tax form from the Marketplace (Form 1095-A) that indicates if the member received APTC. If so, the member must file their federal taxes and, specifically, Form 8962, to “reconcile” the advance payment of the premium subsidies they received. In this reconciliation process, the Internal Revenue Service compares the amount of APTC paid to the member’s health plan each month to lower their premium payment against the PTC amount the member actually qualified for based on their true household income and other factors. If there is a difference, it will affect the member’s refund or the taxes they owe. If an APTC recipient does not file their taxes and does not complete the PTC reconciliation process (on Form 8962), they become ineligible for future PTCs and other Marketplace subsidies. Inaccurate filing is also a risk for members who rely on APTCs and can cause unnecessary financial strain and stress.2

However, up to 7 million individuals, or 5% of the eligible US population, do not file their taxes annually, and nonfiling rates are increasing over time.9,10 Some studies indicate that nonfiling is more common among those whose income falls below the required level to file ($12,000 for singles); immigrants, undocumented individuals, and those who are unaware they are US citizens; those who are self-employed; those who have experienced a family emergency or crisis; and those who do not believe in filing (ie, “tax resisters”).10-14 Related literature shows other groups who may file but do not pay if they owe a balance, a behavior that could also jeopardize important tax credits or subsidies. These groups include senior citizens, families, and beneficiaries who draw their income from tax-free benefit programs such as Supplemental Security Income and Temporary Assistance for Needy Families.14 Limited research exists to explain why certain demographic groups share certain tax behaviors, inviting additional research on the subject.

However, there are, to our knowledge, no comprehensive estimates of how many tax filers forgo public benefits due to nonfiling of taxes. Additionally, few studies have examined tax filing and APTC jointly, resulting in a gap in knowledge surrounding the association between tax filing behaviors and applying for the APTC, as well as factors that encourage or hinder ongoing receipt of health insurance. This study intended to address this lack of knowledge by examining (1) tax filing and APTC behaviors, (2) sociodemographic correlates, and (3) barriers associated with both. The rationale for undertaking this study was to identify opportunities to intervene with Marketplace-eligible households to increase tax filing rates and receipt of critical tax credits in order to increase insurance coverage, as lack of insurance has serious implications for an individual’s health and well-being.

METHODS

In 2021, researchers at Washington University in St Louis surveyed a sample of Marketplace-insured members who were believed to be eligible for APTC based on their income, tax filing status, Marketplace enrollment duration, and other health insurance coverage options.

Procedure

Researchers collaborated with the Centene Center for Health Transformation (CCHT) to secure a sample of Marketplace members who were either currently receiving APTCs or who were believed to be eligible for APTCs but not receiving the tax benefit. CCHT provided a list of email addresses for every member who met the inclusion criteria. The study team emailed a randomly selected sample of 20,000 Ambetter and HealthNet members between March and May 2021 with an invitation to complete a confidential survey on tax filing and tax credits via Qualtrics.

The invitation included consent information and notified participants of a possible incentive (a $5 Amazon gift card) for completing the survey. To make the invitation appear more credible and recognizable to members, researchers personalized the email with the member’s specific health plan name and branding for both email correspondence and the survey itself.

Inclusion/Exclusion Criteria

Members were eligible for inclusion if they were 18 years or older and if they were believed to be eligible for the APTC. To qualify for the APTC, members must have an income between 100% and 400% of the FPL, they must not file a “married filing separately” tax return, and they must not be claimed as a dependent by another person.

Measures

Demographic characteristics. Demographic information pertaining to the individual and their household (eg, age, marital status, education, employment) was collected via a sociodemographic questionnaire used in prior studies.

Tax filing and APTC behaviors and barriers. Tax filing and APTC behaviors and barriers were collected via a 25-item instrument developed by the researchers. Questions were primarily forced-choice or short answer and were organized around 4 main themes: (1) whether members filed taxes for the 2019 tax year and members’ intention to file for the upcoming tax filing season; (2) barriers to filing; (3) whether members applied for the APTC in 2019 and whether they received the APTC; and (4) barriers to applying in 2019 or intending to apply in 2020.

Analytic Plan

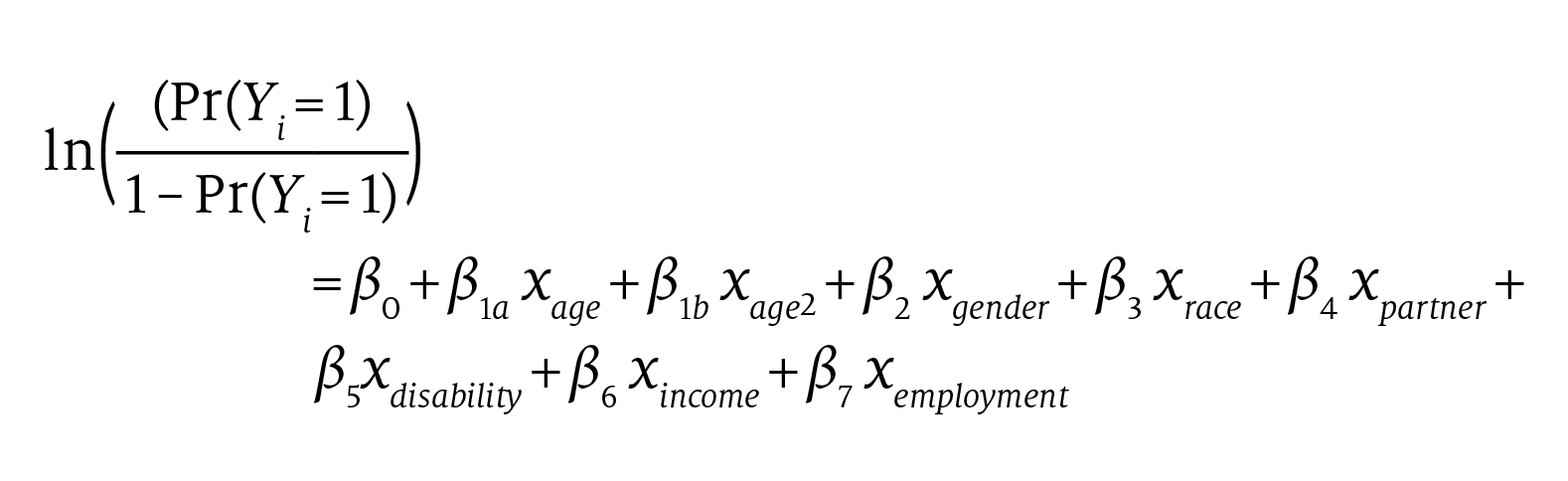

To explore the tax filing and APTC behaviors of members, we employed 2 analytic approaches—descriptive and explanatory. We first describe tax filing and APTC behaviors for the 2019 tax year, as well as members’ intention to file their taxes and apply for the APTC for the 2020 tax year. Also, we descriptively analyzed responses pertaining to what would facilitate tax filing and applying for the APTC. For a better understanding of members’ tax filing and APTC behaviors, we employed logistic regression approaches. That is, tax filing and APTC behaviors were the function of demographic characteristics (age, gender, race, living arrangement, and disability), as well as financial attributes (employment, annual income). In econometric representation,

where Y is a binary outcome regarding tax filing and APTC behavior. For the APTC models, we excluded those who answered that they were not (or would not be) eligible for the APTC.

This study was approved by the Washington University in St Louis Human Research Protection Office.

RESULTS

Sample Characteristics

A total of 372 individuals participated in the study. They had a mean (SD) age of 45.4 (14.3) years and were primarily female (n = 204; 61%), non-Hispanic White (n = 239; 72%), and employed either full or part time (n = 229; 70%). Almost half of the sample was married or living with a partner (n = 159; 47%), 204 (61%) held a bachelor’s degree or higher, and more than half reported an annual income of $50,000 or higher (n = 155; 53.3%) (Table 1).

Tax Filing Behaviors

Most respondents reported filing their taxes for the 2019 tax year (n = 355; 95.4%), and 97% (n = 360) stated they would file their taxes for the 2020 tax year. The most common reasons reported by individuals who did not or were not planning to file their taxes (n = 15) was that they believed their wages fell/will fall below the minimum requirement (n = 9; 60.0%), followed by not believing in filing taxes (n = 2; 13.3%) and that the process was too stressful (n = 2; 13.3%). Analysis of sociodemographic correlates of tax filing status revealed that older respondents were significantly more likely to have filed their tax returns in 2019 and would be more likely to file in 2020 than younger respondents (2019: odds ratio [OR], 1.593; P < .10; 2020: OR, 1.558; P < .05). Additionally, respondents whose income was less than $20,000 were significantly less likely to file their taxes in 2019 compared with those whose income was $50,000 annually or higher (OR, 67.931; P < .05). Two additional findings approached significance. First, female respondents and those who responded with a gender other than female or male were less likely to file in 2019 than were men (OR, 0.005; P < .10). Second, compared with respondents who were employed full time, those who reported being unemployed were less likely to file taxes in 2019 (OR, 0.030; P < .10) (Table 2).

APTC Application

In 2019, slightly less than a quarter of respondents (n = 82; 23.7%) applied for the APTC despite the sample being perceived to be eligible, and 22.5% (n = 78) participants were not sure if they applied for the APTC in 2019. Further, only 26.3% (n = 91) were planning on applying for the APTC in 2020, and an additional 30.3% (n = 105) were not sure if they would apply. Most commonly, respondents were not going to apply because they believed they were not eligible (n = 108; 53.5%), followed by 15.8% (n = 32) who did not know about the APTC, and 9.9% (n = 20) who did not know whether they were eligible.

Analyses of the logistic regression modeling found that employment and income were significantly associated with applying for the APTC in 2019; specifically, part-time workers were significantly more likely than full-time workers to apply for the APTC (OR, 4.361; P < .05), and individuals with an income between $20,000 and $29,999 were significantly more likely to apply for the APTC than those whose income fell below $20,000 (OR, 19.466; P < .05). With respect to applying for the APTC in 2020, individuals who identified as being a race categorized as other, which included all racial groups except White, Black, and Hispanic, were significantly less likely to apply for the APTC than White respondents (OR, 0.134; P < .05), and part-time workers were once again significantly more likely to apply for the APTC than full-time workers (OR, 4.816; P < .05). Two additional associations approached significance: First, individuals with an income between $20,000 and $29,999 were more likely to apply for the APTC than those whose income was less than $20,000 (OR, 9.342; P < .10), and second, female respondents and respondents who did not identify as being male or female were less likely to apply for the APTC than men (OR, 0.358; P < .10) (Table 3).

DISCUSSION

Health insurance coverage is associated with increased access to care and utilization, reduced financial distress, increased treatment and improved outcomes for chronic conditions, improved self-reported health and well-being, and decreased mortality.15 With more than 30 million Americans lacking health insurance and an estimated 8.9 million uninsured individuals eligible for subsidized health insurance coverage, the sociodemographic characteristics associated with APTC status and self-reported barriers are informative for identifying opportunities to intervene.3 Additionally, examining drivers of eligibility, and specifically tax filing behavior, is a critical component of understanding claiming APTC tax credits.16,17 Several findings warrant discussion.

First, more than 95% of the sample reported filing their taxes in 2019 and planned to do so in 2020 (97%), yet fewer than 1 of every 4 individuals applied for or received the APTC. This result suggests that filing for the APTC is not necessarily linked with tax filing status and that noncompliance with filing taxes did not appear to be related to why potentially eligible individuals were not applying for the APTC. Moreover, the barriers that individuals noted in explaining why they did not and were not planning to apply for the APTC were unrelated to tax filing; instead, barriers were specific to a lack of knowledge about the APTC and/or whether the individual was eligible. Indeed, only 26.3% (n = 91) were planning on applying for the APTC in 2020; the remainder were not sure if they would apply or would not apply at all because they believed they were not eligible (n = 108; 53.5%), did not know about the APTC (n = 32; 15.8%), or did not know whether they were eligible (n = 20; 9.9%).

Collectively, these results indicate the need to build knowledge and awareness of the APTC and eligibility. Raising awareness and applying for the APTC could be accomplished through coupling the APTC application process with tax filing assistance programs, and this strategy may have a broader reach if embedded within naturalistic settings that families are likely to frequent, such as health and school settings. For example, a recent study that embedded free tax filing services (StreetCred) within 4 urban Boston pediatric clinics found not only significant increases in filing, but also that 14% of participants reported being new recipients of the EITC and 21% noted having new knowledge about the EITC due to the program.18 Study findings such as these suggest that bundling financial assistance within settings that the target population is likely to frequent may be a more effective way of boosting awareness and hence receipt of the APTC.

Finally, findings of the logistic regression contribute to and broaden our understanding about sociodemographic characteristics associated with APTC filing status. Specifically, income was associated with applying for the APTC in 2019 and intention to apply in 2020, with individuals whose income was less than $20,000 being less likely to apply than those of a higher annual income (between $20,000 and $29,999). Moreover, part-time workers were significantly more likely to apply in 2019 (and intended to apply in 2020) for the APTC compared with full-time workers. Also, notably, female respondents and respondents who did not identify as being male or female were less likely to apply for the APTC in 2019 and to intend to apply in 2020 compared with men. Additional research is required to contextualize these results; however, it is notable that both income and gender were associated with being less likely to file their taxes in 2019 as well, and this suggests that there may be common factors responsible for nonfiling respective to both taxes and the APTC.

Limitations

Several limitations should be taken into account when interpreting the results of this study, including bias due to the low response rate, which limits the generalizability of the study findings; potential bias, as individuals who participated were required to have a computer and be able to navigate an electronic survey; and the possibility that individuals were not familiar with terminology such as the APTC or what it entails, which may have interfered with the accuracy of responses. The generalizability may also be affected by the expansion of APTC under the American Rescue Plan Act. For 2021 and 2022, the APTC amount was expanded for all income levels and is available for some individuals with incomes above 400% of the FPL for the first time.19

CONCLUSIONS

Limitations notwithstanding, this study provides an encouraging start to understanding who is least likely to take advantage of the APTC, perceived barriers, and which populations are at highest risk for not filing.

Author Affiliations: New York University Grossman School of Medicine (MA), New York, NY; University of Minnesota (AB), Minneapolis, MN; The Brown School at Washington University in St Louis (YC, MS, SR, MG-W), St Louis, MO.

Source of Funding: The authors undertook the research and writing of this article with support from the Centene Center for Health Transformation, a partnership between Centene Corporation and Washington University in St Louis (grant number 1642-49808, Washington University in St Louis).

Author Disclosures: The authors report no relationship or financial interest with any entity that would pose a conflict of interest with the subject matter of this article.

Authorship Information: Concept and design (MA, AB, YC, MS, SR, MG-W); acquisition of data (MA, MS); analysis and interpretation of data (MA, YC); drafting of the manuscript (MA, AB, YC, MS, SR); critical revision of the manuscript for important intellectual content (MA, AB, YC, SR, MG-W); statistical analysis (YC); provision of patients or study materials (MA); obtaining funding (MG-W); administrative, technical, or logistic support (AB, MS, MG-W); and supervision (MA, MG-W).

Address Correspondence to: Mary Acri, PhD, New York University Grossman School of Medicine, 1 Park Ave, New York, NY 10016. Email: Mary.acri@nyulangone.org.

REFERENCES

1. Frean M, Gruber J, Sommers BD. Premium subsidies, the mandate, and Medicaid expansion: coverage effects of the Affordable Care Act. J Health Econ. 2017;53:72-86. doi:10.1016/j.jhealeco.2017.02.004

2. APTC and CSR basics. CMS. Accessed October 17, 2022. https://marketplace.cms.gov/technical-assistance-resources/aptc-csr-basics.pdf

3. Keisler-Starkey K, Bunch L. Health insurance coverage in the United States: 2019. US Census Bureau. September 2020. Accessed October 17, 2022. https://www.census.gov/content/dam/Census/library/publications/2020/demo/p60-271.pdf

4. Sommers BD. Health insurance coverage: what comes after the ACA? Health Aff (Millwood). 2020;39(3):502-508. doi:10.1377/hlthaff.2019.01416

5. Blumberg LJ, Garrett B, Holahan J. Estimating the counterfactual: how many uninsured adults would there be today without the ACA? Inquiry. 2015;53:0046958016634991. doi:10.1177/0046958016634991

6. Gunja MZ, Collins SR. Who are the remaining uninsured, and why do they lack coverage? The Commonwealth Fund. August 28, 2019. Accessed October 17, 2022. https://www.commonwealthfund.org/publications/issue-briefs/2019/aug/who-are-remaining-uninsured-and-why-do-they-lack-coverage

7. Earned Income Tax Credit. Accessed October 16, 2022 at https://www.childtaxcredit.gov/eitc/

8. Statistics for tax returns with the Earned Income Tax Credit (EITC). Internal Revenue Service. Updated March 10, 2022. Accessed October 17, 2022. https://www.eitc.irs.gov/eitc-central/statistics-for-tax-returns-with-eitc/statistics-for-tax-returns-with-eitc

9. O’Connell B. Why do so many people fall behind on their taxes? Investopedia. Updated July 31, 2022. Accessed October 17, 2022. https://www.investopedia.com/articles/personal-finance/021214/why-do-so-many-people-fall-behind-their-taxes.asp

10. McKenzie RE. 7 million taxpayers fail to file their income taxes. Forbes. August 27, 2014. Accessed October 17, 2022. https://www.forbes.com/sites/irswatch/2014/08/27/7-million-taxpayers-fail-to-file-their-income-taxes

11. Williamson VS. Americans are proud to pay taxes — except when they think others are cheating. Washington Post. April 18, 2017. Accessed October 17, 2022. https://www.washingtonpost.com/news/monkey-cage/wp/2017/04/18/americans-are-proud-to-pay-taxes-except-when-they-think-others-are-cheating/

12. Zemelman I. Accidental Americans and their plight with US taxes. Taxes for Expats. July 25, 2015. Accessed October 17, 2022. https://www.taxesforexpats.com/articles/expat-tax-rules/accidental-americans-and-their-plight-with-us-taxes.html

13. Herd P, Moynihan D. How administrative burdens can harm health. Health Affairs. October 2, 2020. Accessed October 17, 2022. https://www.healthaffairs.org/do/10.1377/hpb20200904.405159/full/

14. Walters J. We will not pay: the Americans withholding their taxes to fight Trump. Guardian. February 15, 2017. Accessed October 17, 2022. https://www.theguardian.com/us-news/2017/feb/15/tax-refusing-pay-protest-trump

15. Sommers BD, Gawande AA, Baicker K. Health insurance coverage and health—what the recent evidence tells us. N Engl J Med. 2017;377(6):586-593. doi:10.1056/NEJMsb1706645

16. Marketplace enrollees receiving financial assistance as a share of the subsidy-eligible population. Kaiser Family Foundation. Accessed October 17, 2022. https://www.kff.org/health-reform/state-indicator/marketplace-enrollees-eligible-for-financial-assistance-as-a-share-of-subsidy-eligible-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

17. McDermott D, Cox C. A closer look at the uninsured Marketplace eligible population following the American Rescue Plan Act. Kaiser Family Foundation. May 27, 2021. Accessed October 17, 2022. https://www.kff.org/private-insurance/issue-brief/a-closer-look-at-the-uninsured-marketplace-eligible-population-following-the-american-rescue-plan-act/

18. Marcil L, Hole M, Wenren L, Schuler M, Zuckerman B, Vinvi R. Free tax services in pediatric clinics. Pediatrics. 2018;141(6):e20173608. doi:10.1542/peds.2017-3608

19. American Rescue Plan and the Marketplace. CMS. March 12, 2021. Accessed October 17, 2022. https://www.cms.gov/newsroom/fact-sheets/american-rescue-plan-and-marketplace

Quality of Life: The Pending Outcome in Idiopathic Pulmonary Fibrosis

February 6th 2026Because evidence gaps in idiopathic pulmonary fibrosis research hinder demonstration of antifibrotic therapies’ impact on patient quality of life (QOL), integrating validated health-related QOL measures into trials is urgently needed.

Read More

Quality of Life: The Pending Outcome in Idiopathic Pulmonary Fibrosis

February 6th 2026Because evidence gaps in idiopathic pulmonary fibrosis research hinder demonstration of antifibrotic therapies’ impact on patient quality of life (QOL), integrating validated health-related QOL measures into trials is urgently needed.

Read More

2 Commerce Drive

Cranbury, NJ 08512

AJMC®

All rights reserved.