- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Health Insurance, Blood Cancer Care, and Outcomes: A Literature Review

doi: 10.37765/ajmc.2021.88733

INTRODUCTION

The Patient Protection and Affordable Care Act (ACA) established several health insurance reforms important to cancer care in the United States,1 including prohibiting insurers from denying coverage or setting higher premiums on the basis of preexisting health conditions, expanding Medicaid eligibility to adults with incomes up to 138% of the federal poverty level, eliminating the Medicare Part D coverage gap or “donut hole,” and requiring commercial insurers to cover the cost of routine care that a patient receives while enrolled in a clinical trial. Yet despite these reforms, many patients with cancer continue to experience significant financial burden2 and distress associated with their care, referred to as the “financial toxicity” of cancer.3,4

Financial toxicity is particularly prevalent among patients with blood cancer, who are increasingly treated with expensive, orally administered anticancer drugs. A rapid rise in the cost of these drugs has offset the savings patients should have seen from the closing of the donut hole.5 Consequently, many of the more than 1.3 million people in the United States who are either living with, or are in remission from, blood cancer6 face higher out-of-pocket costs than patients with other cancers.7 Additionally, patients with blood cancer report a myriad of other access barriers, ranging from lack of insurance and inadequate provider networks to coverage denials. With recent growth in the availability of health plans that do not comply with the ACA’s market reforms, these barriers are likely to grow.8

In light of these challenges, there is an urgent need to identify insurance reforms that can meaningfully improve access to affordable, high-quality care for patients with blood cancer. To assess the current evidence base for such reforms, we conducted a literature review and gap analysis. Our aims were, first, to identify and categorize current evidence regarding the impact of health insurance status and type on access to care and outcomes among patients with blood cancer, and second, to identify areas of uncertainty and key research gaps.

Methods

We conducted a systematic search of Medline’s PubMed database on June 5, 2020, and an additional targeted author search on July 1, 2020. Search terms included relevant Medical Subject Headings as well as relevant blood cancer and insurance keywords. Search terms were identified by reviewing key terms in recent insurance and blood cancer publications and were developed in collaboration with experts and in consultation with an information scientist. The search was supplemented by reviewing the bibliographies of any identified review articles. The combined searches yielded 1101 articles. To identify the subset of relevant publications that would inform policymakers and the scientific field of the insurance research landscape related to blood cancer care and outcomes, we screened titles and abstracts for eligibility against a set of inclusion and exclusion criteria. Studies were eligible for inclusion if they involved patients with blood cancer at any stage on the cancer care continuum and had a focus on insurance. We included studies with insurance as the primary focus of the study and studies in which insurance was a variable or an outcome of the study. All study designs were eligible, including review articles and qualitative research. We excluded studies specifically focused on cancers other than blood cancer but included general cancer studies if they were known to or very likely to include patients with blood cancer. We excluded studies published before January 2000, those conducted outside of the United States (or its territories), and those not in the English language. We also excluded animal and in vitro studies, letters to the editor, and publication comments.

To provide an overview of the available scientific literature and a gap analysis to identify areas of uncertainty and research that are missing or underrepresented, we categorized included articles using the population, intervention, comparator, and outcomes framework9 to structure data abstraction.

Given the scope and purpose of the review, categorization was based on a review of abstracts by a single research analyst and quality checked by a senior methodologist. We did not conduct a risk-of-bias assessment, and we retrieved full texts only for studies that did not include an abstract or when relevant information was not presented in the abstract. Abstracted categories included study title, author, publication year, sample size, study design, cancer focus, population group, insurance type, cancer continuum, comparator, and outcome. For each category, we established predefined coding variables and abstracted the main insurance-related outcome finding into a free-text field. The categorization process was primarily conducted on the information available in the study abstract.

Results

Overview of the Research Landscape

Following title and abstract review, we identified 154 publications for inclusion, 70 of which had a direct focus on insurance as the subject of the article; of those, 39 focused specifically on blood cancers. Studies were predominantly large retrospective cohort studies often using Medicare claims data or the National Cancer Institute–funded Surveillance, Epidemiology, and End Results (SEER) registry data or SEER-Medicare data as the basis for analysis. Almost half of the retrospective studies focused on the association between insurance status or type and an outcome of interest. The remainder reported insurance as one of several factors found to be associated with a clinical outcome (eg, survival), quality of cancer care, or access to treatment. One prospective cohort study assessed the quality of cancer care for older patients provided by the Veterans Health Administration vs fee-for-service Medicare.10 Of 2 identified systematic reviews, one 2005 study was specific to blood cancer and found (from very limited quality-of-life [QOL] data) that individuals with chronic lymphocytic leukemia experience challenges obtaining health insurance.11 The other was a recent 2020 systematic review that investigated evidence related to health insurance coverage disruptions and cancer outcomes and found that those patients with coverage disruption were more likely to have advanced disease, be less likely to receive treatment, and have worse survival than their counterparts without coverage disruptions.12

More than half of the identified studies addressed multiple types of insurance, and Medicare was the focus of 16% of studies. Medicaid was rarely studied as the sole focus of a study. Studies with a focus on adults (65 years and younger) were most common, addressed in one-third of all included studies, followed by adolescents and young adults (addressed in 21% of studies) and older adults (addressed in 19%). Children were a focus of just 9% of included studies, and a handful of sSutudies were not focused on any patient population but rather on physician opinion or practices.13-15 Of the 39 studies specific to blood cancer and insurance, none specifically focused on diverse racial and ethnic groups or patients in rural settings.

Studies tended to focus on patients in active treatment, addressed by 42% of all included studies. Survivorship was also commonly studied, addressed in almost a quarter of studies. Notably, just 2 studies addressed treatment in the context of clinical trial participation, one of which specifically focused on patients with blood cancer.16 A 2014 case study by Preussler and colleagues highlighted state variation in Medicaid coverage of complex oncology treatments for blood cancer and found that only a few states provided the recommended benefits (ie, benefits recommendations developed by multiple stakeholders) for hematopoietic cell transplantation clinical trial coverage.16

Mortality/survival and access to care were among the outcomes most often studied, addressed in 35% and 33% of the 154 included studies, respectively. Studies addressing access to care were broad and included the impact of insurance status and type on receipt of or timeliness of treatment; health care utilization; and access to specialist care, high-cost treatments, and financial assistance such as cost-sharing subsidies. Very few studies focused on the relationship between insurance coverage and the occurrence of treatment-related adverse events (TRAEs) or cancer recurrence, and among studies specifically focused on blood cancers, very few addressed the relationship between insurance and quality of care or QOL. Similarly, very few studies investigated insurance-related disparities in health outcomes based on race/ethnicity or on socioeconomic factors.

Key Insurance-Related Findings and Gaps Specific to Blood Cancer

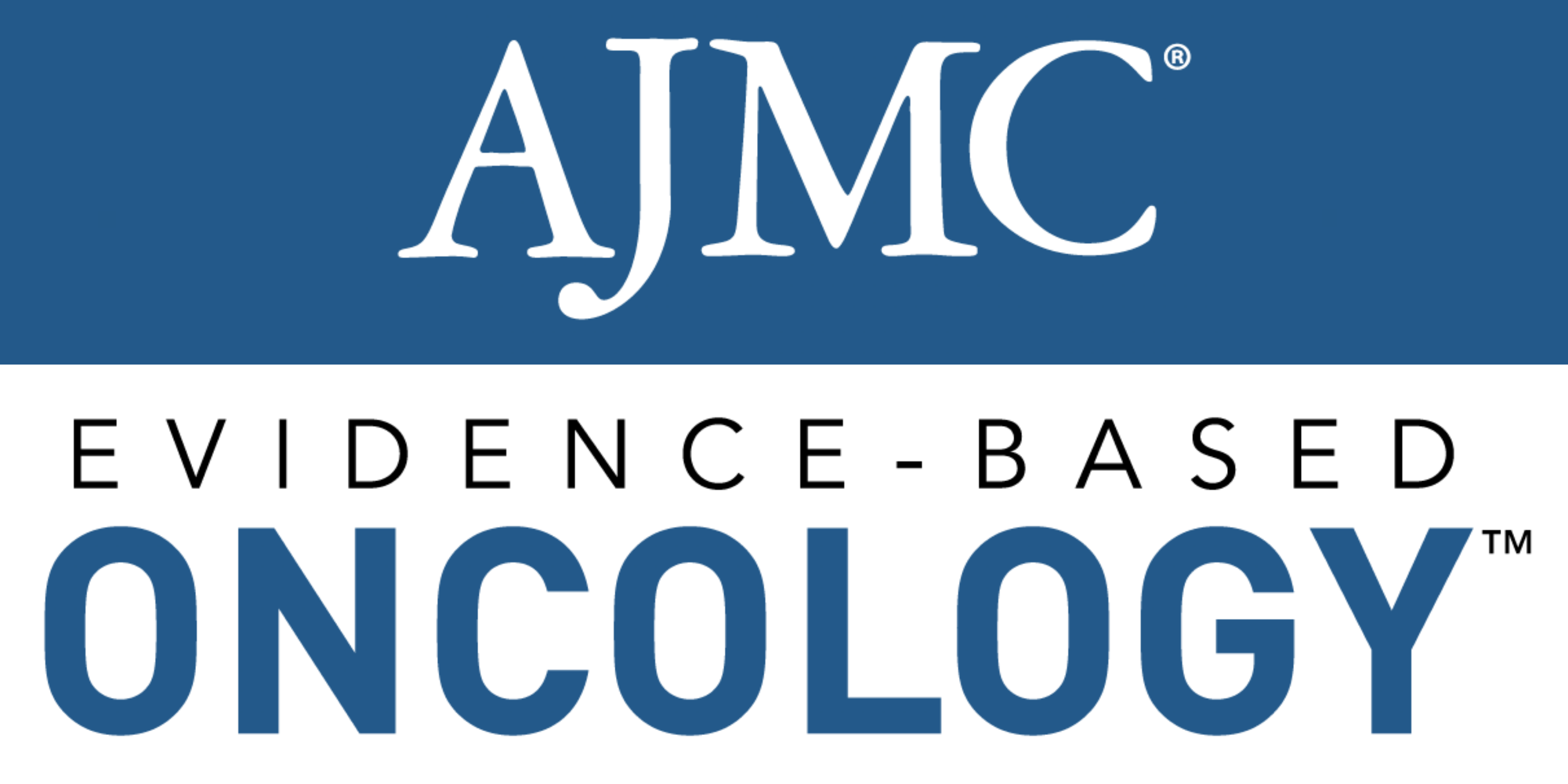

Insurance and survival. Fifty-six percent of studies that focused specifically on blood cancer and insurance (22 of 39) reported survival as an outcome of interest. Of these, 21 examined the impact of insurance status or type on survival (Table). Seventeen studies found disparities in overall survival (OS) based on insurance status and type,17-32 2 reported no difference in OS based on insurance type,33,34 and 2 reported mixed findings.35,36 All but one study reporting survival disparities were large retrospective registry studies, and overwhelmingly, they reported better survival among patients with insurance compared with those with no insurance and better survival among patients with private commercial insurance compared with other insurance types. In contrast, the 2 studies reporting no difference in OS based on insurance type were small chart reviews.33,34

TABLE.

Of the 2 studies reporting mixed survival outcomes, both were large registry database studies. One found increased OS among Medicaid-enrolled beneficiaries compared with non–Medicaid-enrolled beneficiaries (with the non-Medicaid group including both commercially insured and uninsured patients) with acute myeloid leukemia and Hodgkin lymphoma enrolled in New York State; however, there was no such difference in survival among Medicaid beneficiaries enrolled in California.35 In a 2015 study, Olszewski and Foran found that when confounding factors are considered, insurance-associated lymphoma survival disparities are partly mediated by the prevalence of known prognostic factors or by patients’ preexisting medical conditions that at the time drove eligibility for Medicaid and Medicare; these authors noted that cancer registries generally do not contain information about comorbidities or other confounders.36

One study assessed the timeliness of care (defined as time from payer approval to actual HCT) and its impact on OS for patients who underwent hematopoietic cell transplantation (HCT).37 Total time to HCT was longer for patients insured by public payers than for those with private insurance (median, 66 days [range, 14-277] vs 48 days [range, 1-407]; P < .001), but timeliness was not associated with OS.37

Insurance and financial burden. Thirteen of 39 studies that focused specifically on blood cancer included financial burden as an outcome of interest.17,38-49 Overall, the findings point to a significant insurance-related financial burden for patients with blood cancer. Notably, most studies addressed financial burden among Medicare beneficiaries, whereas few studies investigated the size and impact of the financial burden placed on uninsured patients and Medicaid beneficiaries with blood cancer. Of 13 studies, 8 focused on Medicare Part D. Of these, 5 reported increased financial burden on patients related specifically to high cost-sharing under Medicare Part D,41-45 3 of which also reported that high cost-sharing under Medicare Part D was associated with reduced or delayed initiation of specialty drugs (ie, tyrosine kinase inhibitors [TKIs]).41-43 The other 3 studies addressing Medicare Part D looked at low-income subsidies among recipients; one found that among Medicare beneficiaries without low-income subsidies, the introduction of Medicare Part D discounts provided during the Part D coverage gap phase decreased patients’ financial burden46; the second reported a substantial financial barrier to accessing orally administered anticancer therapy for those not receiving low-income subsidies.47 The third study found that compared with Medicare Part D recipients who did not receive low-income subsidies, those patients who were heavily or moderately subsidized demonstrated greater nonadherence to TKI treatment.48 This study demonstrated an association between low-income subsidies and nonadherence but did not claim that low-income subsidies cause nonadherence.48 Unrelated to Medicare Part D, a small study found that among 20 US cancer center directors and chief medical officers surveyed, 15 were concerned about the financial viability of their chimeric antigen receptor T-cell immunotherapy programs, citing Medicare reimbursement rates and manufacturer prices as the primary drivers of viability concerns.40

Two studies reported financial burden for those with commercial health insurance. A 2014 study

reported on the financial burden associated with higher copayments,49 and a 2001 (pre-ACA) study

reported that 61% of survey respondents paid out of pocket for some aspect of medical care that was not covered by their health insurance coverage following a diagnosis of hairy cell leukemia.39 Just one study from 2015 reported on the financial burden for Medicaid beneficiaries with blood cancer,38 and a 2011 study reported on the costs of inpatient treatment for uninsured patients with acute myeloid leukemia.17

Access to insurance. A few studies analyzing pre-ACA data highlighted the difficulty in obtaining

health insurance (or in navigating gaps in insurance) following a blood cancer diagnosis.39,50,51 Expanding access to comprehensive health insurance coverage was a primary mission of the ACA,1 and now, post ACA, a blood cancer diagnosis is no longer the threat it once was to a patient’s ability to enroll and stay enrolled in a health plan. Although multiple studies have examined the impact of the ACA on insurance coverage and insurance-related outcomes pre- and post implementation, only one pre-post ACA study was found to have focused on a population of patients with blood cancer. In a 2019 registry study, Ramachandran and colleagues observed no

difference in the rates of newly diagnosed cutaneous T-cell lymphoma by insurance type (defined as uninsured, Medicaid insured, and non-Medicaid insured) before and after full implementation of the ACA.52 This was true when looking across all states, whether Medicaid expansion or nonexpansion states.52 Also related to access, one study found that lack of insurance was associated with advanced stage of Hodgkin lymphoma diagnosis.53

Insurance and clinical trial access. Only one study looked at insurance-related access to clinical

trial participation for patients with blood cancer. A 2014 case study investigating the variation in Medicaid policies among states in 2012 found that only a few states provided the recommended benefits (ie, recommended benefits developed by multiple stakeholders) for hematopoietic cell transplantation clinical trial coverage.16

Insurance and race/ethnicity. A number of studies reported an association between race/ethnicity and blood cancer outcomes, with poorer outcomes for patients who are Hispanic, African American and non-Hispanic Black.17,29,30,35,53 However, just 2 examined whether race/ethnicity remained associated with varying outcomes after adjusting for insurance status,35,53 and both found that race/ethnicity was no longer significantly associated with blood cancer outcomes when regression models were adjusted for insurance status.16

Insurance and other outcomes. Only a handful of blood cancer–specific studies addressed quality

of care16,41,46,53 or health-related QOL (HRQOL)39 as outcomes of interest, and these were not primary outcomes of any of the identified studies. The relationship between these outcomes and insurance status among patients with blood cancer remains largely unknown.

Discussion/Gaps in the Current Evidence

A modest body of scientific evidence suggests that survival among patients with blood cancer is

affected by insurance status and type, with better OS among the insured vs the uninsured and better OS among those with commercial insurance vs public insurance. Similarly, studies of registry and claims data suggest a significant insurance-related financial burden for patients with blood cancer.

However, a number of limitations are associated with the existing literature, which ultimately hinder

the development of evidence-based policymaking in this area. Evidence of the associations among insurance status, insurance type, survival, and financial burden are based primarily on retrospective cohort studies that may fail to control for comorbidities and confounders. Additional studies, including prospective cohort studies and large well-controlled registry studies examining the impact of insurance on survival and financial burden, could confirm current findings and delve into key subgroups. Almost no current research is focused on important outcomes beyond survival and financial burden, such as the impact of insurance on clinical trial participation, quality of care, HRQOL outcomes, TRAEs, and cancer recurrence. Access to trials, in particular, has been of longstanding interest to policymakers; Congress recently passed the Clinical Treatment Act to improve trial-related coverage for Medicaid beneficiaries. Implementation of this law would be enhanced by research exploring whether uninsurance or underinsurance might continue to act as a barrier to trial participation in the future, as well as the reforms that would be needed to address such barriers in full.

Few studies have focused on diverse racial and ethnic groups, patients with low income, Medicaid beneficiaries, uninsured patients, and patients residing in rural settings. Similarly, relatively few studies have focused on adolescents and young adults, and just 14 studies (9%) focused on families with a pediatric patient. As a result, little is known about the impact of insurance on blood cancer care within these vulnerable populations. Although policymakers have expressed commitments to addressing health disparities, evidence-based policymaking in this area will be constrained by the gaps in this literature.

No peer-reviewed studies have examined blood cancer outcomes related to short-term, limited-duration health plans and other types of insurance-like products (eg, fixed indemnity plans or health care sharing ministries) that do not comply with the ACA’s market reforms and thus require plan enrollees to assume significant financial risk. With several million people already enrolled in some of these plan types,54 it is critical to know the extent to which such coverage contributes to large-scale financial toxicity for patients living with costly diseases like blood cancer.

No studies have evaluated the implementation of interventions designed to improve access to or use of insurance among patients with blood cancer (eg, patient navigators focused on insurance access; insurance-related education programs). Implementation research should examine the methods and strategies that facilitate the uptake of evidence-based insurance-related programs and guidelines into practice. Such research would be timely because the Biden administration has identified increased enrollment in qualified health plans as necessary to stabilize the ACA’s insurance marketplaces, and policymakers have recently expressed a desire to curb broker practices that steer unwitting patients to inferior health insurance plans.54

Conclusions

The current body of peer-reviewed literature provides evidence that insurance status and type affect OS and financial burden for patients with blood cancer. However, evidence is insufficient on the impact of insurance on other important outcomes, including clinical trial participation, quality of care, and HRQOL. In addition, evidence specific to key vulnerable populations is insufficient. Further research is needed to guide policymaking in these areas and to help patients effectively navigate the health insurance marketplace, gain better access to high-quality care, and achieve better health outcomes.

AUTHOR INFORMATION. Karen Crotty, Katherine Treiman, Candi Wines, and Catherine Viator are with RTI International; Marialanna Lee, Maria Sae-Hau, and Elisa Weiss are with The Leukemia &

Lymphoma Society.

CORRESPONDING AUTHOR: Karen Crotty, RTI International, 3040 E Cornwallis Road, Hobbs 139, P.O. Box 12194, Durham, NC 27709. E-mail: kcrotty@rti.org.

FUNDING SOURCE. This work was funded by The Leukemia & Lymphoma Society.

References

1. Zhao J, Mao Z, Fedewa SA, et al. The Affordable Care Act and access to care across the cancer control continuum: a review at 10 years. CA Cancer J Clin. 2020;70(3):165-181. doi:10.3322/caac.21604

2. Hong Y-R, Smith GL, Xie Z, Mainous AG III, Huo J. Financial burden of cancer care under the Affordable Care Act: analysis of MEPS--

experiences with cancer survivorship 2011 and 2016. J Cancer Surviv. 2019;13(4):523-536. doi:10.1007/s11764-019-00772-y

3. Carrera PM, Kantarjian HM, Blinder VS. The financial burden and distress of patients with cancer: understanding and stepping-up action on the financial toxicity of cancer treatment. CA Cancer J Clin. 2018;68(2):153-165. doi:10.3322/caac.21443

4. Lentz R, Benson AB III, Kircher S. Financial toxicity in cancer care: prevalence, causes, consequences, and reduction strategies. J Surg Oncol. 2019;120(1):85-92. doi:10.1002/jso.25374

5. Dusetzina SB, Huskamp HA, Keating NL. Specialty drug pricing and out-of-pocket spending on orally administered anticancer drugs in Medicare Part D, 2010 to 2019. JAMA. 2019;321(20):2025-2027. doi:10.1001/jama.2019.4492

6. Howlader N, Noone AM, Krapcho M, et al. SEER Cancer Statistics Review, 1975-2016. National Cancer Institute/Surveillance, Epidemiology, and End Results Program. Updated April 9, 2020. Accessed July 28, 2021. https://seer.cancer.gov/archive/csr/1975_2016/

7. Dieguez G, Ferro C, Rotter D. Milliman Research Report: the cost burden of blood cancer care: a longitudinal analysis of commercially insured patients diagnoses with blood cancer. Leukemia & Lymphoma Society. October 2018. Accessed March 2, 2021. https://www.lls.org/sites/

default/files/Milliman%20study%20cost%20burden%20of%20blood%20

cancer%20care.pdf

8. Palanker D, Lucia K, Goe CL. Opportunities to better protect consumers and markets from the negative impact of short-term plans. The Commonwealth Fund. January 14, 2021. Accessed January 31, 2021. https://www.commonwealthfund.org/blog/2021/opportunities-better-protect-

consumers-and-markets-negative-impact-short-term-plans?utm_

source=alert&utm_medium=email&utm_campaign=Health%20

Coverage

9. Samson D, Schoelles KM. Developing the topic and structuring systematic reviews of medical tests: utility of PICOTS, analytic frameworks, decision trees, and other frameworks. In: Chang S, Matchar DB, Smetana GW, Umscheid CA, eds. Methods Guide for Medical Test Reviews

[Internet]. Rockville (MD): Agency for Healthcare Research and Quality (US); 2012 Jun:chapter 2.

10. Keating NL, Landrum MB, Lamont EB, et al. Quality of care for older patients with cancer in the Veterans Health Administration versus the private sector: a cohort study. Ann Intern Med. 2011;154(11):727-736. doi:10.7326/0003-4819-154-11-201106070-00004

11. Stephens JM, Gramegna P, Laskin B, Botteman MF, Pashos CL. Chronic lymphocytic leukemia: economic burden and quality of life: literature review. Am J Ther. 2005;12(5):460-466. doi:10.1097/01.mjt.0000104489.93653.0f

12. Yabroff KR, Reeder-Hayes K, Zhao J, et al. Health insurance coverage disruptions and cancer care and outcomes: systematic review of published research. J Natl Cancer Inst. 2020;112(7):671-687. doi:10.1093/jnci/djaa048

13. Pidala J, Craig BM, Lee SJ, Majhail N, Quinn G, Anasetti C. Practice variation in physician referral for allogeneic hematopoietic cell transplantation. Bone Marrow Transplant. 2013;48(1):63-67. doi:10.1038/bmt.2012.95

14. Schaefer NG, Huang P, Buchanan JW, Wahl RL. Radioimmunotherapy in non-Hodgkin lymphoma: opinions of nuclear medicine physicians and radiation oncologists. J Nucl Med. 2011;52(5):830-838. doi:10.2967/jnumed.110.085589

15. Dusetzina SB, Basch E, Keating NL. For uninsured cancer patients, outpatient charges can be costly, putting treatments out of reach. Health Aff (Millwood). 2015;34(4):584-591. doi:10.1377/hlthaff.2014.0801

16. Preussler JM, Farnia SH, Denzen EM, Majhail NS. Variation in Medicaid coverage for hematopoietic cell transplantation. J Oncol Pract. 2014;10(4):e196-e200. doi:10.1200/jop.2013.001155

17. Bradley CJ, Dahman B, Jin Y, Shickle LM, Ginder GD. Acute myeloid leukemia: how the uninsured fare. Cancer. 2011;117(20):4772-4778. doi:10.1002/cncr.26095

18. Colton MD, Goulding D, Beltrami A, et al. A U.S. population-based study of insurance disparities in cancer survival among adolescents and young adults. Cancer Med. 2019;8(10):4867-4874. doi:10.1002/cam4.2230

19. Olszewski AJ, Dusetzina SB, Trivedi AN, Davidoff AJ. Prescription drug coverage and outcomes of myeloma therapy among Medicare beneficiaries. J Clin Oncol. 2018;36(28):2879-2886. doi:10.1200/jco.2018.77.8894

20. Goldstein JS, Nastoupil LJ, Han X, Jemal A, Ward E, Flowers CR. Disparities in survival by insurance status in follicular lymphoma. Blood. 2018;132(11):1159-1166. doi:10.1182/blood-2018-03-839035

21. Tang R, Su C, Bai HX, et al. Association of insurance status with survival in patients with cutaneous T-cell lymphoma. Leuk Lymphoma.

2019;60(5):1253-1260. doi:10.1080/10428194.2018.1520987

22. Pulte D, Castro FA, Brenner H, Jansen L. Outcome disparities by insurance type for patients with acute myeloblastic leukemia. Leuk Res. 2017;56:75-81. doi:10.1016/j.leukres.2017.02.001

23. Perry AM, Brunner AM, Zou T, et al. Association between insurance status at diagnosis and overall survival in chronic myeloid leukemia: a population-based study. Cancer. 2017;123(13):2561-2569. doi:10.1002/cncr.30639

24. Ortiz-Ortiz KJ, Ortiz-Martínez de Andino JJ, Torres-Cintrón CR, et al. Effect of type of health insurance coverage on leukemia survival in adults in Puerto Rico. P R Health Sci J. 2014;33(3):132-135.

25. Fintel AE, Jamy O, Martin MG. Influence of insurance and marital status on outcomes of adolescents and young adults with acute lymphoblastic leukemia. Clin Lymphoma Myeloma Leuk. 2015;15(6):364-367. doi:10.1016/j.clml.2014.12.006

26. Master S, Munker R, Shi Z, Mills G, Shi R. Insurance status and other non-biological factors predict outcomes in acute myelogenous leukemia: analysis of data from the National Cancer Database. Anticancer Res. 2016;36(9):4915-4921. doi:10.21873/anticanres.11057

27. Selby GB, Ali LI, Carter TH, Veseley S, Roy V. The influence of health insurance on outcomes of related-donor hematopoietic stem cell transplantation for AML and CML. Biol Blood Marrow Transplant. 2001;7(10):576. doi:10.1016/s1083-8791(01)70018-3

28. Pulte D, Jansen L, Brenner H. Survival disparities by insurance type for patients aged 15-64 years with non-Hodgkin lymphoma. Oncologist. 2015;20(5):554-561. doi:10.1634/theoncologist.2014-0386

29. Costa LJ, Brill IK, Brown EE. Impact of marital status, insurance status, income, and race/ethnicity on the survival of younger patients diagnosed with multiple myeloma in the United States. Cancer.

2016;122(20):3183-3190. doi:10.1002/cncr.30183

30. Keegan TH, DeRouen MC, Parsons HM, et al. Impact of treatment and insurance on socioeconomic disparities in survival after adolescent and young adult Hodgkin lymphoma: a population-based study. Cancer Epidemiol Biomarkers Prev. 2016;25(2):264-273. doi:10.1158/1055-9965. epi-15-0756

31. Han X, Jemal A, Flowers CR, Sineshaw H, Nastoupil LJ, Ward E. Insurance status is related to diffuse large B-cell lymphoma survival. Cancer. 2014;120(8):1220-1227. doi:10.1002/cncr.28549

32. Parikh RR, Grossbard ML, Green BL, Harrison LB, Yahalom J. Disparities in survival by insurance status in patients with Hodgkin lymphoma. Cancer. 2015;121(19):3515-3524. doi:10.1002/cncr.29518

33. Srour SA, Machiorlatti M, Pierson NT, et al. Impact of health care insurance status on treatment outcomes of acute myeloid leukemia. Clin Lymphoma Myeloma Leuk. 2017;17(7):450-456.e2. doi:10.1016/j.clml.2017.05.011

34. Al-Ameri A, Anand A, Abdelfatah M, et al. Outcome of acute myeloid leukemia and high-risk myelodysplastic syndrome according to health insurance status. Clin Lymphoma Myeloma Leuk. 2014;14(6):509-513. doi:10.1016/j.clml.2014.03.003

35. Yung RL, Chen K, Abel GA, et al. Cancer disparities in the context of Medicaid insurance: a comparison of survival for acute myeloid leukemia and Hodgkin’s lymphoma by Medicaid enrollment. Oncologist. 2011;16(8):1082-1091. doi:10.1634/theoncologist.2011-0126

36. Olszewski AJ, Foran JM. Health insurance-related disparities in lymphoma survival are partly mediated by baseline clinical factors. Oncologist. 2015;20(10):1223-1224. doi:10.1634/theoncologist.2015-0228

37. Bhatt VR, Loberiza FR Jr, Schmit-Pokorny K, Lee SJ. Time to insurance approval in private and public payers does not influence survival in patients who undergo hematopoietic cell transplantation. Biol Blood Marrow Transplant. 2016;22(6):1117-1124. doi:10.1016/j.

bbmt.2016.03.008

38. Huntington SF, Weiss BM, Vogl DT, et al. Financial toxicity in insured patients with multiple myeloma: a cross-sectional pilot study. Lancet Haematol. 2015;2(10):e408-e416. doi:10.1016/s2352-3026(15)00151-9

39. Hounshell J, Tomori C, Newlin R, et al. Changes in finances, insurance, employment, and lifestyle among persons diagnosed with hairy cell leukemia. Oncologist. 2001;6(5):435-440. doi:10.1634/theoncologist.6-5-435

40. Leech AA, Neumann PJ, Cohen JT, Jagasia M, Dusetzina SB. Balancing value with affordability: cell immunotherapy for cancer treatment in the US. Oncologist. 2020; 25(7):e1117-e1119. doi:10.1634/theoncologist. 2020-0025

41. Doshi JA, Li P, Huo H, et al. High cost sharing and specialty drug initiation under Medicare Part D: a case study in patients with newly diagnosed chronic myeloid leukemia. Am J Manag Care. 2016;22(4 Suppl):s78-s86.

42. Doshi JA, Li P, Pettit AR, Dougherty JS, Flint A, Ladage VP. Reducing out-of-pocket cost barriers to specialty drug use under Medicare Part D: addressing the problem of “too much too soon.” Am J Manag Care. 2017;23(3 Suppl):s39-s45.

43. Winn AN, Keating NL, Dusetzina SB. Factors associated with tyrosine kinase inhibitor initiation and adherence among Medicare beneficiaries with chronic myeloid leukemia. J Clin Oncol. 2016;34(36):4323-4328. doi:10.1200/jco.2016.67.4184

44. Shen C, Zhao B, Liu L, Shih Y-CT. Financial burden for patients with chronic myeloid leukemia enrolled in Medicare Part D taking targeted oral anticancer medications. J Oncol Pract. 2017;13(2):e152-e162. doi:10.1200/jop.2016.014639

45. Davidoff AJ, Hendrick FB, Zeidan AM, et al. Patient cost sharing and receipt of erythropoiesis-stimulating agents through Medicare Part D. J Oncol Pract. 2015;11(2):e190-e198. doi:10.1200/jop.2014.001527

46. Jung J, Xu WY, Cheong C. In-gap discounts in Medicare Part D and specialty drug use. Am J Manag Care. 2017;23(9):553-559.

47. Olszewski AJ, Dusetzina SB, Eaton CB, Davidoff AJ, Trivedi AN. Subsidies for oral chemotherapy and use of immunomodulatory drugs among Medicare beneficiaries with myeloma. J Clin Oncol. 2017;35(29):3306-3314. doi:10.1200/jco.2017.72.2447

48. Shen C, Zhao B, Liu L, Shih Y-CT. Adherence to tyrosine kinase inhibitors among Medicare Part D beneficiaries with chronic myeloid leukemia. Cancer. 2018;124(2):364-373. doi:10.1002/cncr.31050

49. Dusetzina SB, Winn AN, Abel GA, Huskamp HA, Keating NL. Cost sharing and adherence to tyrosine kinase inhibitors for patients with chronic myeloid leukemia. J Clin Oncol. 2014;32(4):306-311. doi:10.1200/jco.2013.52.9123

50. Chen AB, Feng Y, Neuberg D, et al. Employment and insurance in survivors of Hodgkin lymphoma and their siblings: a questionnaire study. Leuk Lymphoma. 2012;53(8):1474-1480. doi:10.3109/10428194.2012.660629

51. Smits-Seemann RR, Kaul S, Hersh AO, et al. ReCAP: gaps in insurance coverage for pediatric patients with acute lymphoblastic leukemia. J Oncol Pract. 2016;12(2):175-176; e207-e214. doi:10.1200/jop.2015.005686

52. Ramachandran V, Park KE, Shah JR, Duvic M. Diagnosis of cutaneous T-cell lymphoma by insurance type before and after the Affordable Care Act: a national database study. Dermatol Online J. 2019;25(11):13030/qt5n4481mk.

53. Smith EC, Ziogas A, Anton-Culver H. Association between insurance and socioeconomic status and risk of advanced stage Hodgkin lymphoma in adolescents and young adults. Cancer. 2012;118(24):6179-6187. doi:10.1002/cncr.27684

54. E&C investigation finds millions of Americans enrolled in junk health insurance plans that are bad for consumers & fly under the radar of state regulators. News release. House Committee on Energy & Commerce; June 25, 2020. Accessed January 31, 2021. https://energycommerce.

house.gov/newsroom/press-releases/ec-investigation-finds-millionsof-americans-enrolled-in-junk-health

55. Goldstein JS, Switchenko JM, Behera M, Flowers CR, Koff JL. Insurance status impacts overall survival in Burkitt lymphoma. Leuk Lymphoma. 2019;60(13):3225-3234. doi:10.1080/10428194.2019.1623884

Lymphoma Research Foundation CEO on Biden’s Cancer Moonshot, Financial Toxicity

February 3rd 2022On this episode of Managed Care Cast, we speak with Meghan Gutierrez, CEO of the Lymphoma Research Foundation, about financial toxicity, how the pandemic has affected patients’ financial needs when they have cancer, health care disparities and care gaps, and more.

Listen

BrECADD Regimen Reaches “Unprecedently High” PFS for Patients With Hodgkin Lymphoma

June 18th 2024The treatment regimen not only significantly improved progression-free survival (PFS) for patients with advanced stage classic Hodgkin lymphoma but was also better tolerated compared with a 20-year-old regimen being used.

Read More

Keeping Patients With Cancer Out of the ED Through Dedicated Urgent Care

October 13th 2021On this episode of Managed Care Cast, we bring you an interview conducted by the editorial director of OncLive® who talks with the advance practice provider chief at Winship Cancer Institute about how having a dedicated cancer urgent care center will make cancer treatment plans seamless whil helping patients avoid exposure to infectious diseases in emergency department waiting rooms.

Listen

alloHSCT Yields Benefits in R/R AML Regardless of Leukemia Burden

December 22nd 2023Those with chronic graft-versus-host-disease who have received allogeneic hematopoietic stem cell transplant (alloHSCT) may experience enhanced graft-versus-leukemia effects, thus producing a lower relapse rate in acute myeloid leukemia.

Read More

ICYMI: Highlights From ASH 2023

December 20th 2023The most-read content from the 2023 American Society of Hematology Annual Meeting and Exposition included the latest in treating hematologic malignancies, the hope brought by novel therapy strategies, and the potential for artificial intelligence to improve diagnostic accuracy.

Read More