- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Contributor: Medication Adherence Is a “Force Multiplier” for Medicare Advantage Profitability, Enrollment, Star Ratings

Medication adherence is a key part of Medicare Advantage, and its importance to improving Star Ratings necessitate a renewed focus on the measure.

There’s never been a more critical time for Medicare Advantage (MA) plans to focus on improving medication adherence. It’s a key component of the overall strategy for the MA plan to improve Star Ratings, competitiveness for the annual enrollment period (AEP), and overall plan profitability.

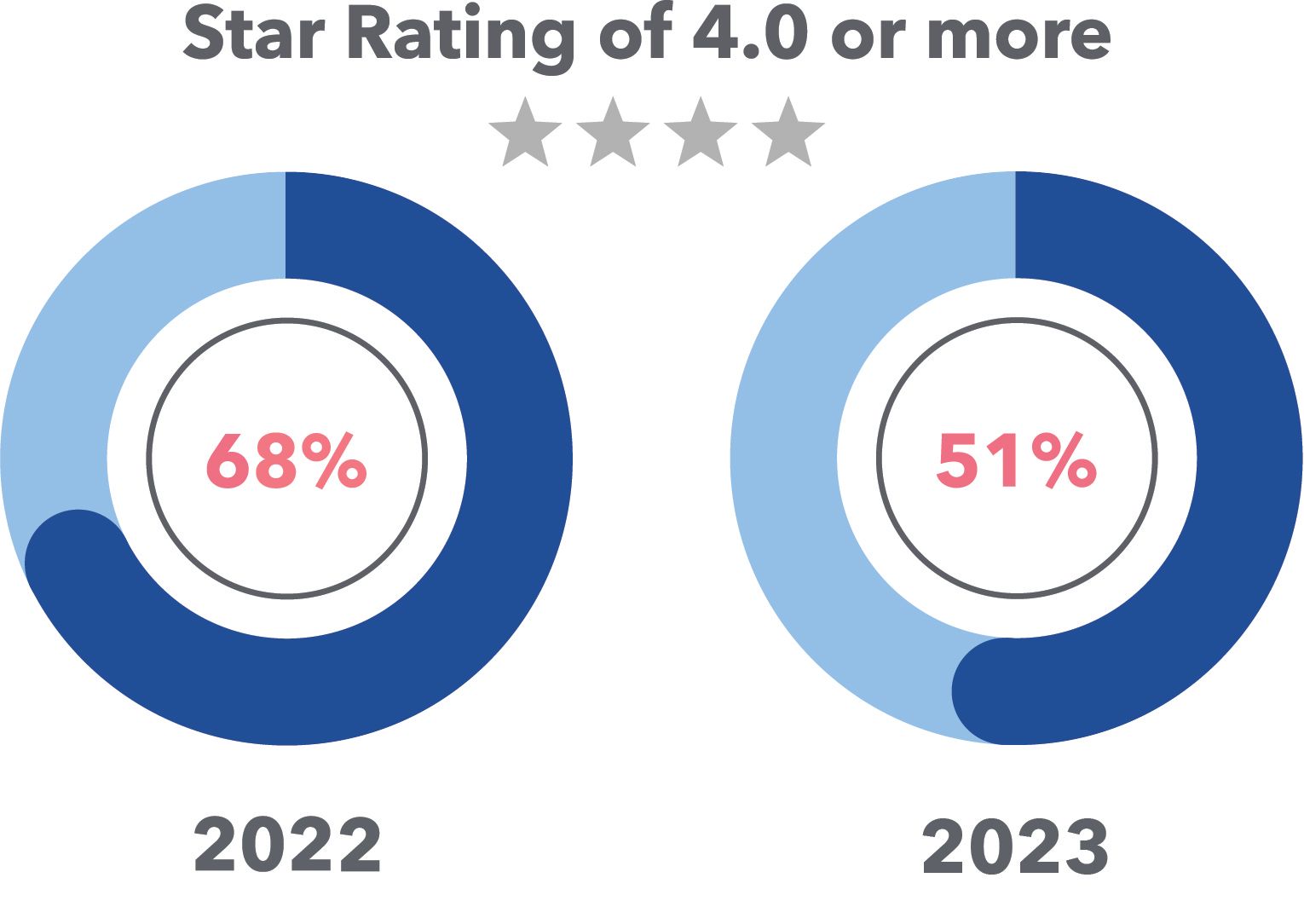

With the COVID-19 public health crisis tapering off, CMS is demanding plans refocus on outcomes by ending critical Star Rating performance safeguards designed to protect plans during the crisis. As a result, 2022 Star Ratings performances that rose to all-time highs have now dropped back down to Earth. CMS notes nearly 70% of MA prescription drug plans earned a rating of 4.0 Stars or higher in the 2022 Star Ratings compared with 51% for 2023.

Improving and/or maintaining high-performing MA Star Ratings can be challenging, even for plans that excel each year. Rising cut point thresholds make it even harder to move the needle and reach or exceed 4.0 Stars, the point when plans can start to capture Quality Bonus Payment (QBP) distributions. The infusion of these performance-based revenues improves member benefits, ultimately attracting more enrollees. Between the QBP and approximately 3 million new members being added annually to MA, as well as lower voluntary attrition, health plans stand to gain a portion of the approximately $50 billion in available revenues each year.

Medication adherence is a “force multiplier” directly related to many other heavily weighted and influential components of the Star Ratings system. What plans should be aware of is the influence of triple-weighted medication adherence measures, along with their cascading impact to related Healthcare Effectiveness Data and Information Set (HEDIS) and Consumer Assessment of Healthcare Providers and Systems (CAHPS) measures. Fortunately, there is a path to be a step ahead of the curve— maximizing year-round medication adherence performance.

There is no dispute that medication adherence is critical for plans to achieve the Triple Aim of health care: better outcomes, improved patient experience, and lower cost of care.

The Star Ratings system continues to get more challenging

The Star Ratings rubric constantly evolves to keep MA plans on their toes.

Among the 34% of measures whose cut points got harder to achieve for 2023, Star Ratings are some of the most historically challenging for health plans. The cut points for key medication adherence measures, including hypertension renin-angiotensin-system (RAS)-acting agents adherence, medication for cholesterol (statin) adherence, and statin use in persons with diabetes, have all become harder for plans to reach higher performance. These measures are also triple weighted and heavily influence overall Stars performance for plans.

MA plans must find new strategies to navigate an increasingly challenging environment for members whoi are perpetually nonadherent. Focusing on areas that have the highest impact on the Star Ratings, such as medication adherence, will help ensure plans can earn their maximum performance. In turn, MA plans can successfully achieve exponentially greater success, which results in more QBP dollars, better member benefit offerings, and the key prize: increased membership enrollment revenues.

Darwinism in health care: Star Ratings' impact on “plan survival”

The aggregate Star Rating a plan achieves is imperative to its profitability and growth. Further, without QBP funding from CMS, the health plan can’t afford competitive member benefits and lower premiums. These facts directly impact plan selection during the Medicare AEP, where beneficiaries choose their insurance option. Moreover, after the beneficiary inputs their ZIP code and prescription drugs into the Medicare enrollment website, CMS automatically custom sorts MA plans with the best benefits, lowest premiums, and highest Star Rating.

With an average of about 40 MA plans to choose from on multiple screens to click through, the first few plans displayed can automatically gain preference for member selection. On the other hand, plans with fewer benefits, higher premiums, and lower Star Ratings are sequenced in the latter pages of plans to select. For members already enrolled in MA plans that score less than 3.0 Stars for 3 years in a row, CMS can send a letter to the member, encouraging them to immediately change to a health plan with a higher Star Rating. Also, beginning this year, CMS now restricts membership enrollment growth for plans scoring 2.5 Stars or lower.

It’s also important to note that in the 2023 Star Ratings, average voluntary member attrition rose to 17.15% (up almost 2.5 points from 2022)—reflecting members who chose to leave their MA plan and enroll in a different plan. This is critical to plan survival, given that revenue lost through member attrition ($15,250 per covered person per a recent report from the Kaiser Family Foundation) will need to be made up by plans through member enrollment.

To summarize the overall impact of Star Ratings, plans with more Stars lead toward more revenue through increased member enrollment. A landmark Guidehouse study found that plans earning 1 additional Star can expect an enrollment bump between 8% and 12%. Those findings validated prior research published in JAMA linking the Star Rating system’s association with beneficiary enrollment decisions to an increase of 9.5% enrollment growth. But this isn’t the only consideration for plans looking to improve their Star Rating.

The Guidehouse study went further, documenting that plans improving from a 3.0-Star to 4.0-Star Rating would increase plan revenues between 13.4% and 17.6% through increased enrollment revenue and QBP. In effect, Star Ratings scores direct approximately $50 billion in revenue for MA plans.

For example, consider an MA plan with 50,000 enrolled members. By moving from 3.0 to 4.0 Stars, the plan would earn a combination of bonuses and rebates that would affect average annual revenue per member (growing estimated benchmark of $15,000). Along with anticipated enrollment growth of 6000 new members per year—a 12% increase based on the Guidehouse study assertions of increased enrollment—the plan could expect to see an estimated $134 million in revenue growth (more membership and higher revenue per member), all stemming from higher performance on the all-important Star Ratings.

Medication adherence: the compounding catalyst

In and of itself, medication adherence has a direct impact on the 2023 Star Ratings:

- Medication adherence (3x weighting; ~9% of overall Star Rating)

- Medication adherence for hypertension (RAS antagonists)

- Medication adherence for cholesterol (statins)

- Medication adherence for diabetes medications

Medication adherence is also a transformative influence permeating every Star Ratings framework layer. It’s a force multiplier directly related to many other heavily weighted and influential components of the system, including:

- CAHPS patient experience (33% of overall Star Rating): Medication adherence improvement is a pathway to overall engagement improvement; thus, the tactics used in the adherence program inherently impact CAHPS patient experience measures.

- Drug plan quality improvement (5.2% of overall Star Rating): The quality improvement factor comprises year-over-year measure momentum across Part D, heavily influenced by medication adherence and CAHPS measures.

- Part C blood sugar and pressure control measures (4.2% of overall Star Rating): Diabetes blood sugar control and controlling blood pressure measure outcomes directly tie to medication adherence—after all, this control is the direct target of these prescriptions.

- Statin use in persons with diabetes and statin use in persons with cardiovascular disease (2.1% of Star Ratings);: Statin compliance is the cornerstone of these condition-specific measures. Getting overall statin utilization patterns on track directly influences these scores.

As a reflection of behavioral persistence, a proxy for experience and satisfaction, a lever for normal laboratory results, an ingredient in trend measurement, and an important corollary of retention, medication adherence carries so much weight that it warrants significant attention. Forward-thinking plans must invest in proactive and comprehensive year-round medication adherence engagement programs, particularly for the complex, high-risk members who typically struggle with managing their medications.

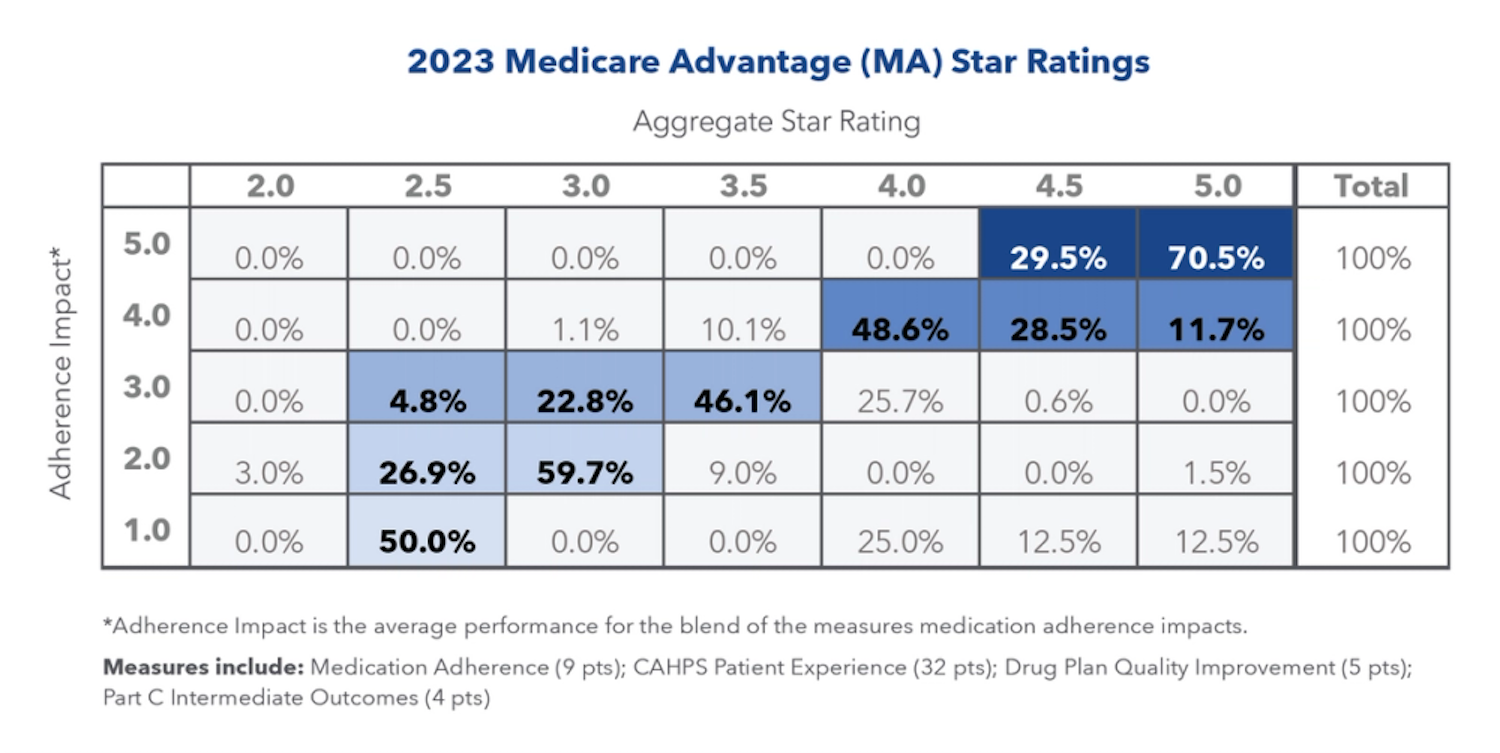

Reviewing the 2023 Star Ratings results (released in October 2022 for 2021 plan year results), medication adherence measure performance had a profound impact on the overall Star Rating. Per the summary below, the following perspectives clearly convey how impactful medication adherence measures (including the triple-weighted RAS, statin, and diabetes measures) are to the overall MA Star Rating:

Further details are described in the following table:

Developing and deploying a robust, year-round medication adherence strategy will help plans achieve their Triple Aim goals for upcoming performance periods and achieve higher Star Ratings in an increasingly competitive environment.

This article was updated on April 25, 2023, to correct a percentage.

At the 6-year mark, CheckMate 9LA reveals significant long-term survival benefits for metastatic non-small cell lung cancer patients using dual immunotherapy with nivolumab and ipilimumab. These data were featured in the 2025 Year in Review in Non-Small Cell Lung Cancer.

Read More