- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Contributor: CAHPS and Medication Adherence Now Dominate Medicare Advantage Star Ratings

Dual-eligible Special Needs Plans are at highest risk with newest CMS changes.

When CMS announced its Contract Year 2021 Star Ratings formula updates, the agency sent a clear message—Medicare Advantage Prescription Drug (MAPD) plans need to get serious about consumer experience and continue high focus on medication adherence. MAPD plans that fall below the 4-Star threshold risk losing approximately $500 per member per year reimbursement improvement as a part of the nearly $7 billion annual Quality Bonus Payment (QBP) pool allocated by CMS. What’s more, the changing weights put Dual-eligible Special Needs Plans (DSNP) (ie, Medicare/Medicaid enrollees) at the highest risk. As the QBP pool is finite, it is Darwinism for health care where only the plans with the strongest quality plans can compete. These higher quality plans are required to use the increased value-based reimbursement toward more member benefits and thereby have a better product to compete for consumers.

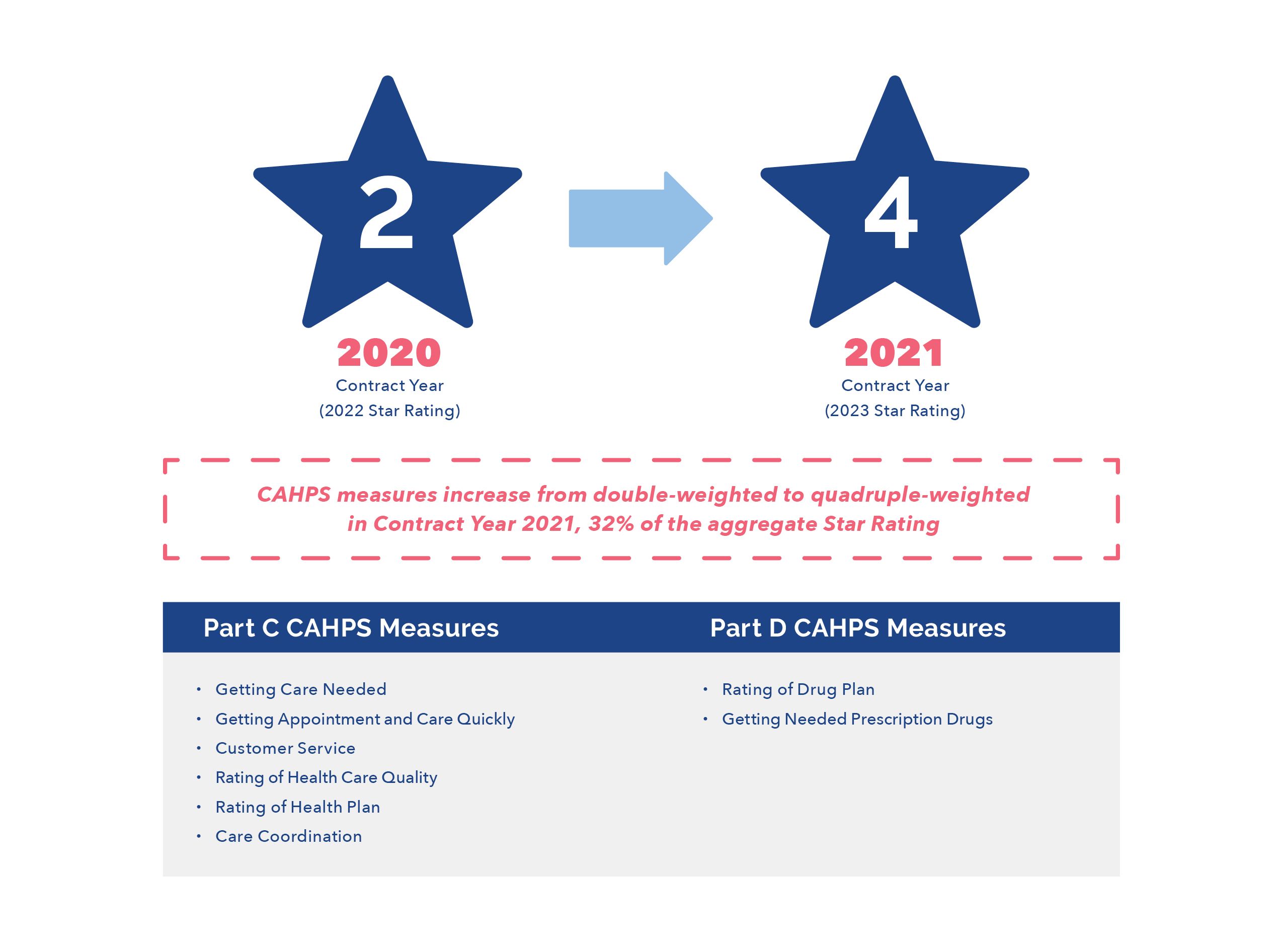

Consumer Assessment of Healthcare Providers and Systems (CAHPS) survey measures (Figure 1) were already double weighted (2x) in Contract Year 2020. However, in the 2021 contract year, CMS increased the importance of these measures by quadruple-weighting (4x) them to be 32% of the overall Star Rating.

Figure 1: MA Star Ratings CAHPS weighting year-over-year comparison (2020 vs 2021 contract year)

CAHPS surveys ask beneficiaries (or caregivers) about their consumer experience with, and ratings of, their providers (eg, hospitals, home health care, hospitals) and health plans. Per CMS, the intention of these statistically validated surveys is to illustrate “perceived key aspects of their care, not how satisfied they were with their care…such as how they experienced critical aspects of health care, including communication with their doctors, understanding their medication instructions, and the coordination of their healthcare needs.” All surveys officially designated as CAHPS surveys have been approved by the CAHPS Consortium, which is overseen by the Agency for Healthcare Research and Quality (AHRQ).

On the surface, MAPD plans have maintained stable performance on CAHPS scores overall by averaging 3.34 Stars and 3.33 Stars in Contract Year 2019 and 2018. However, MAPD plans face higher exposure to not reach the overall 4-Star threshold for the QBP under the updated weighting methodology. As proactive plans place higher focus on CAHPS leading up to the March 2021 surveys, consumer experience measures will drive further differentiation between high performers and low performers next year.

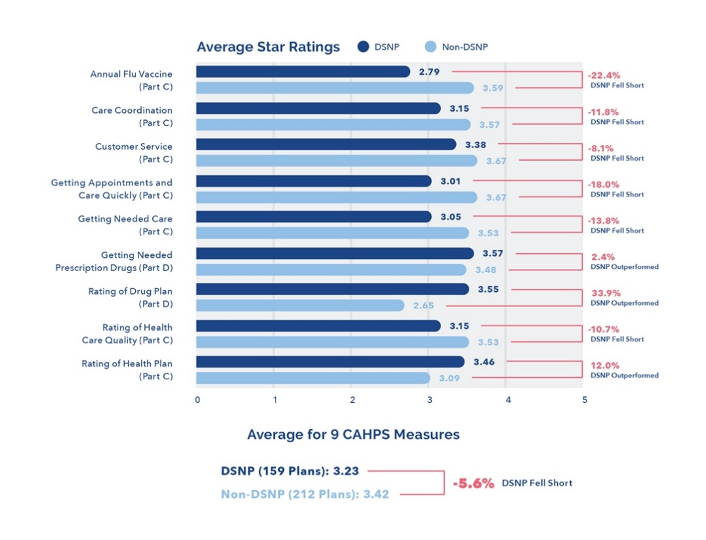

Not all plans will weather these measurement weighting adjustments equally. For example, deeper analysis into the measures by plan type reveals DSNPs perform quite differently as compared to other MAPD plans (Figure 2). CMS already adjusts quality and adherence measures for DSNPs, but does not provide a curve for CAHPS. DSNPs performed 5.8% worse for CAHPS measures as compared to non-DSNP plans in Contract Year 2018 when the weighting was 1.5x. The weighting shifting to 4x in 2021 will have a tremendous impact to DSNPs. Further, while all plans must generally place greater higher focus on CAHPS, DSNP plans performed better in Contract Year 2019 (see Figure 2) on Part D than non-DSNP plans likely due to improved prescription drug plan benefits (eg, cost sharing more favorable to members). Conversely, DSNPs performed far worse than non-DNSPs on Part C CAHPS measures.

Figure 2: AdhereHealth analysis of DSNP vs MAPD plan performance on 2019 Medicare Advantage contract year measures

Consumer experience, therefore, has become a business imperative. MAPD plans and in particular DSNP plans, must address CAHPS measures as part of their daily consumer engagement to maximize quality measures improvement. CAHPS surveys are typically collected between March and May each year, so plans that are focused on the 2021 contract year in late 2020 leading up to the reporting period will be at an advantage.

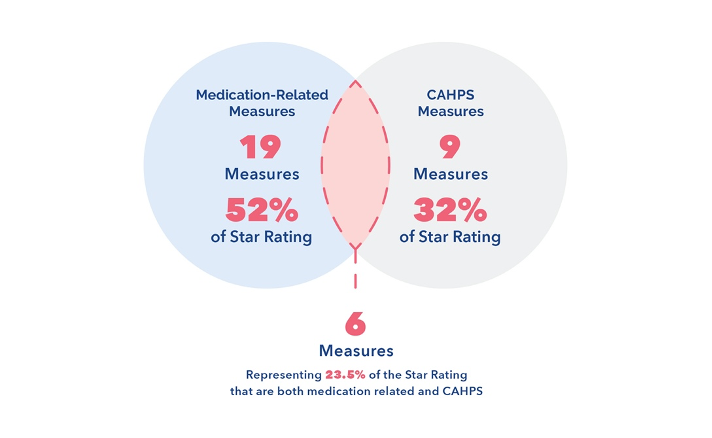

It is clear, however, that consumer experience must be a year-round focus as a part of other quality improvement activities, most notably those focused on medication-related measures. An analysis of Medicare Advantage Part C and D measures for the 2021 contract year reveals 52% of experience improvement, process, and outcomes measures are anchored to medication use (Figure 3). Further, there are two 5x measures that are also impacted by CAHPS measures: C29 – Health Plan Quality Improvement and D06 - Drug Plan Quality Improvement.

Figure 3: Weighting impact of medication-related and CAHPS measures on Star Ratings in 2021 contract year

Indeed, to drive material improvement of consumer experience measures plans will need to take a holistic and consumer-centric approach to providing access to care. Even concerted efforts to improve individual processes are unlikely to move the needle sufficiently or maximize results. Consumer experience can reflect the totality of a plan’s operation—as the customer experiences it. The approach to consumer experience measures must focus broadly across the organization to encompass any area that touches the consumer.

Barriers to Consumer Experience Improvement

There may be a wide array of barriers to consumer experience improvement, but 2 fundamental challenges for health plans include:

- Organizational design: Operationally, Consumer Experience transcends departments such as Pharmacy, Health Services, Quality, Member Services, and Marketing. While a single medication adherence measure, such as D10 - Medication Adherence for Diabetes Medications, might be the focus of the pharmacy team, the overall consumer experience may not be any team’s primary focus.

Moreover, a diabetic consumer likely has several other gaps to be addressed during the contract year across Part C and Part D measures, such as Eye Exam, Kidney Disease Monitoring, Blood Sugar Controlled, Care of Older Adults, Statins Use for People with Diabetes, and Medication Therapy Management. However, most health plans do not consider the number of outreaches from different departments, physician offices and vendors attempting to reach out to the same member throughout the year to close each gap. Therefore, the consumer experience will be poor (and inefficient) if these outreach efforts are not calibrated throughout the year. - Social Determinants of Health (SDOH): At the root of CAHPS consumer experience scores are consumers’ ability to access needed care. Barriers to care for many consumers include issues like lack of transportation, health literacy, lack of funds for health care services or pharmacy copayments, and the inability to navigate administrative hurdles.

Gaps in SDOH have been exacerbated in the wake of COVID-19, particularly in vulnerable dual eligible populations. Given the fundamental nature of these issues in determining the health of populations, plans must consider investing proactive outreach to high-risk consumers to assess their needs and provide additional support. In particular, drilling down into individual situations is vital to understanding and removing any SDOH, or socioeconomic issues, impeding a consumer’s ability to fill a prescription and take medication. For example, a consumer who needs help getting to a medical appointment may also need transportation to a pharmacy following the appointment; otherwise, the consumer may go straight home, unable to fill the prescription.

Eliminating co-payments for chronic medications can alleviate barriers to care. Switching consumers to combination medications that treat two conditions at once is another approach to breaking down barriers. For example, consumers with diabetes can be put on a combined insulin-statin medication, which the plan purposely puts on a lower formulary tier, instead of having to take separate medications. The consumer is now ingesting one less drug and incurs lower out-of-pocket costs. This approach helps engage the consumer so they are more open to working with the health plan on adhering to their medications.

Best Practices for Improving Health Plan Consumer Experience

A rigorous, effective approach to improving consumer experience will need to vary by plan, but plans that want to best position themselves for future Star Ratings success would be wise to consider these strategies:

- Break down organizational silos. Consumers simply do not care whose department is responsible for their experience, they just want a good experience and action. Similarly, consumers have grown accustomed to customer relationship management (CRM) tools that enable seamless communications across touchpoints. In health care, such continuity across encounters will become increasingly important as consumer expectations matter more to health plan performance. To approach consumer experience from the consumer’s perspective, plan leaders will need their organizations to work across departments and to center operational improvements around the consumer. For example, if a consumer with a gap in care calls with a benefit question, health plans have the opportunity to simultaneously address any barriers causing the care gap. Regardless of who in the organization has consumer contact, they must have a full picture of the consumer’s needs and capitalize on every opportunity to better understand that consumer and improve their access to care.

This approach, paired with integrated data and intelligent clinical workflow platforms, can extend from plans to their provider networks. Through seamless workflows and data-sharing, MAPD plans can engage their provider partners as fellow champions of medication adherence and consumer experience improvements. - Orient the plan around what it can do rather than on what it cannot. Most health plans are not set up to optimize consumer experience, nor is the health system overall. Lack of follow-up care might reflect burdens created by the plan’s referral requirements. It is also increasingly important for plans to help coordinate care, access medication, and reduce nonmedical barriers to care. Tackling these types of barriers may be necessary to unlocking greater improvements in key measures like “getting needed care.” Documenting these discrete actions in the CRM so that there are specific actions taken and ongoing reporting will help show consumers how plans are driving better care.

- Embrace customer data and seek hidden truths. Health plans are experts at conducting customer satisfaction surveys, but CAHPS samples are relatively small and can be easy to dismiss if the results are unfavorable. Instead of explaining why results might not be all positive, plans will benefit from sober examination of the data. What kernels of truth emerge that plans can exploit for improvement?

Any health plan leader can look at their survey scores and see measures that have room for improvement. Deeper analytics, though, can reveal real drivers of performance, and point to potential strategies for improvements based on root-cause analysis.

The Benefits of Consumer Experience Improvements

Improving consumer experience and medication adherence measures will have the direct, near-term effect of improving Star Ratings. Not only will improved Star Ratings increase reimbursement to payers, the funds will create richer benefits to attract and retain membership.

The challenge is how to improve consumer experience while remaining efficient. Plans need a holistic technology platform to support this effort. The system should provide systematic predictive analytics to identify highest-impact focus areas, and intelligent clinical workflows for improving key Star Rating measures simultaneously. Analytics are also vital for revealing points of leverage—those areas on which plans can focus to drive the greatest overall results, and developing tangible action plans with effective interventions that enable plans to compete for value-based care reimbursements in the highly competitive Medicare Advantage vertical.

Leveraging technology to strategically engage with consumers and respond to their needs will position the plans for the future as CMS continues to increase their expectations for consumer experience. Longer term, CMS has signaled they are considering including Net Promoter Scores (NPS) in future Star Ratings. A standard measure of customer loyalty, NPS captures how likely a customer is to recommend the organization to others. To do well on this measure, plans will need more loyal enthusiasts (“promoters”) than unsatisfied customers (“detractors”). Good consumer experience will increasingly be more competitive.

Summary of Necessary Operational Structure Changes and Technology Investments

Amazingly, despite the incredible focus on the multibillion dollar Star Ratings QBP pool, health plans almost exclusively use antiquated case management tools, spreadsheets and transactional measure campaigns to close gaps. Even the most advanced health plans that focus on consumer experience and tackling SDOH use free text case management notes to document the consumer interaction. This approach eliminates the ability to use the interaction to drive the next step in the consumer’s adherence journey. Further, free text cannot be reported or assessed in any meaningful way.

In addition, it is very common for health plans to have a disconnected approach to consumer engagement strategies and tactics. Moreover, Pharmacy teams are accountable for Part D measures, Quality teams are accountable for HEDIS measures and Member Services and/or Marketing are accountable for CAHPS/HOS consumer experience measures. The result is a disconnected approach to consumer and provider engagement, higher health plan resource costs, and lower consumer experience.

With consumer experience increased to be 32% of the weighting, and medication-related measures representing 52% of Star measures, health plans would be wise to consider implementing a platform that enables a comprehensive approach to improving their Star Ratings.

Using predictive analytics to target at-risk consumers proactively year-round with a data-driven clinical workflow through a CRM system is critical to compete. Modern tools leverage near real-time health plan data (eg, medical claims, pharmacy claims, hospital discharge, HEDIS, consumer surveys) to produce near real-time target and stratification of at-risk measures to guide clinicians in their engagement with consumers and their doctors. The CRM tool should be robust in features, enabling real-time clinical focus to address SDOH, leverage health plan benefits, available community resources and pharmacy enrollment to maximize the engagement. Tackling SDOH actions in a discrete method, not free text notes, will enable additional analytics and reporting.

The effect of a broader focus on the consumer’s experience, and of this outreach to improve their care, can be directly correlated to Part C and Part D CAHPS measures. These investments would support the plan’s internal operational cadence enabled by an integrated consumer approach to drive better value-based care.

Reflection and commitment to improvement will not only be essential to survive the near-term Star Ratings methodology changes, it will position plans to succeed long term as CMS continues to raise the bar in the future.

Author Information

Jason Z. Rose, MHSA, is CEO of AdhereHealth.