- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Growth in Telehealth from 2016 to 2017 Outpaces Other Venues of Care Studied in Second Annual FAIR Health Report

From 2016 to 2017, private insurance claim lines for services rendered via telehealth as a percentage of all medical claim lines grew 53% nationally, more than any other venue of care studied for that variable in the second annual edition of FH Healthcare Indicators. FAIR Health, a national, independent, nonprofit organization dedicated to bringing transparency to healthcare costs and health insurance information, released this report, along with the second annual edition of the FH Medical Price Index, in a just published white paper. The white paper combining both reports is based on FAIR Health’s database of over 28 billion privately billed healthcare claim records—the largest such repository in the country.

Like the inaugural release a year ago, this year’s edition of FH Healthcare Indicators and the FH Medical Price Index is intended to assist the full spectrum of healthcare stakeholders by providing clarity in a rapidly changing healthcare environment.

FH Healthcare Indicators

FH Healthcare Indicators reveal trends and patterns in the places where patients receive healthcare. Focusing on alternative places of service—retail clinics, urgent care centers, telehealth, and ambulatory surgery centers (ASCs)—as well as emergency departments (EDs), FH Healthcare Indicators evaluate changes in utilization, geographic and demographic factors, diagnoses, procedures and costs.

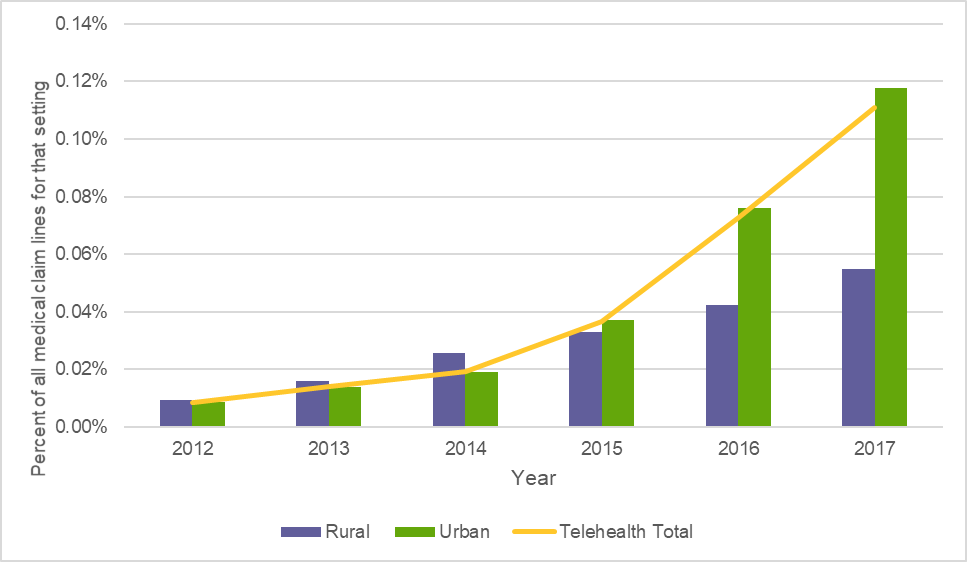

From 2016 to 2017, by comparison with telehealth’s 53% national growth rate (Figure 1), national usage of urgent care centers increased 14%, of retail clinics 7% and of ASCs 6%, while that of EDs decreased 2%.

Figure 1: Claim Lines With Telehealth Usage as a Percentage of All Medical Claim Lines by Rural, Urban and National Settings, 2012-2017

Source: FAIR Health

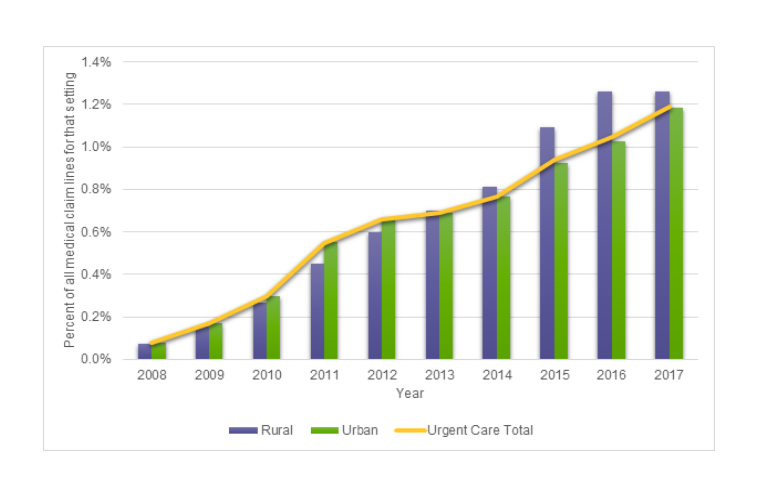

From 2008 to 2017, urgent care center usage grew 1434% (Figure 2), more than 7 times that of EDs (194%). This was a continuation of the trend from 2007 to 2016 reported in last year’s edition, when urgent care center usage growth also had been more than 7 times greater than ED growth.

Figure 2. Claim Lines with Urgent Care Center Usage as a Percentage of All Medical Claim Lines by Rural, Urban and National Settings, 2008-2017

Source: FAIR Health

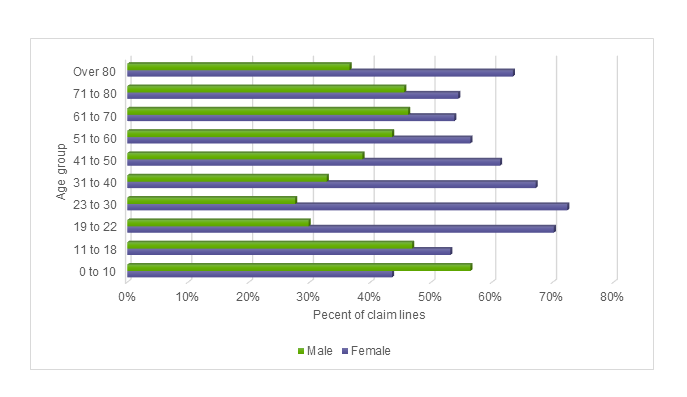

In 2017, as in 2016, more claim lines were submitted for women than for men in all adult age groups in the places of service in which FAIR Health studied gender-related patterns—retail clinics, urgent care centers, telehealth, ASCs and EDs. For example, in retail clinics, the only age group in which claim lines for males outnumbered those for females was that of children aged 0 to 10 (Figure 3).

Figure 3. Claim Lines with Retail Clinic Usage by Age and Gender, 2017

Source: FAIR Health

FH Medical Price Index

The FH Medical Price Index reports shifts in costs and facilitates useful comparisons among medical prices in six procedure categories:

- Professional evaluation and management (E&M1; excluding E&Ms performed in a hospital setting);

- Hospital E&M (excluding E&Ms performed in a professional setting, such as typical office visits);

- Medicine (excluding E&Ms);

- Surgery (procedures for which the physician would bill);

- Pathology and laboratory (technical and professional components, e.g., both equipment and physician services); and

- Radiology (technical and professional components).

The reports reflect professional fees and related costs; they do not reflect facility fees.

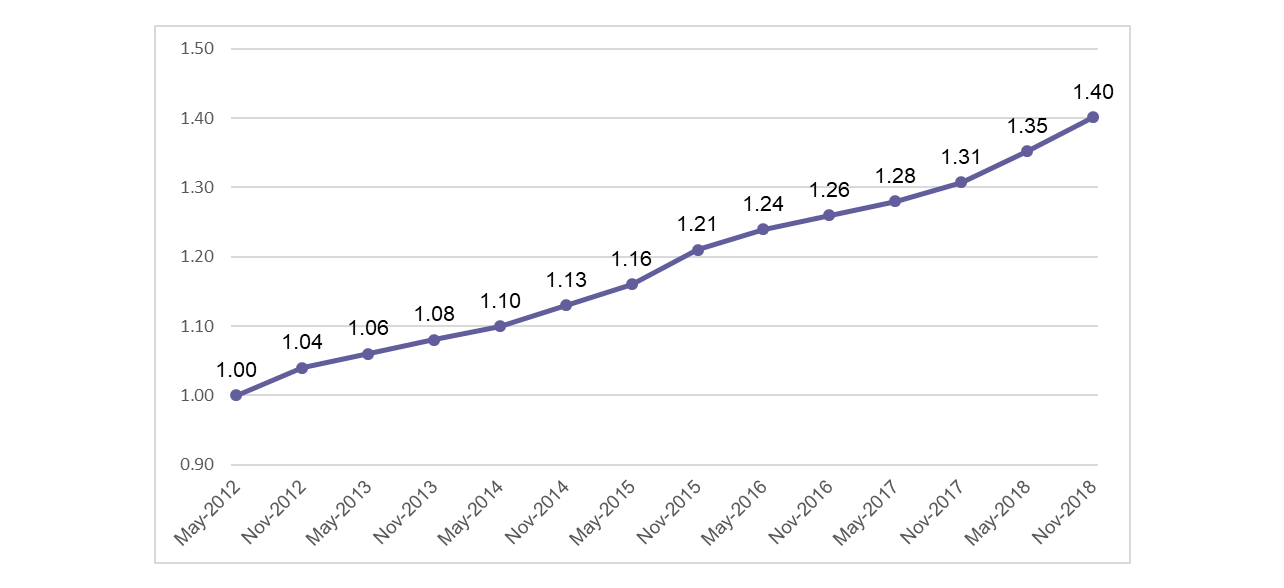

In the first edition, the FH Medical Price Index presented an overview from May 2012 to May 2017. In the new edition, the indices are extended to November 2018. Of the 6 categories, hospital E&Ms had the greatest percent increase in billed charge amount index for the period November 2017 to November 2018—7% (Figure 4). Hospital E&Ms and radiology had the greatest percent increase in allowed amount indices in that period, both 7%, while the radiology charge amount index grew 6%.

Figure 4. Hospital E&M Charge Amount Index

Source: FAIR Health

The first edition of FH Healthcare Indicators and the FH Medical Price Index drew a welcome public response, as stakeholders expressed appreciation for being offered this “macro” view into the nation’s healthcare system. We hope that this new edition continues to inform decision making throughout the healthcare sector by payors, providers, government officials, policy makers, academic researchers and others.

Robin Gelburd, JD, is the president of FAIR Health, a national, independent, nonprofit organization with the mission of bringing transparency to healthcare costs and health insurance information. FAIR Health possesses the nation’s largest collection of private healthcare claims data, which includes over 28 billion claim records contributed by payers and administrators who insure or process claims for private insurance plans covering more than 150 million individuals. Certified by CMS as a national Qualified Entity, FAIR Health also receives data representing the experience of all individuals enrolled in traditional Medicare Parts A, B and D; FAIR Health houses data on Medicare Advantage enrollees in its private claims data repository. Ms. Gelburd is a nationally recognized expert on healthcare policy, data and transparency.

Note

1. An E&M is a patient-provider visit, such as for an examination, to diagnose illness or to determine or manage treatment. Professional E&Ms are typically done in a professional setting, such as a doctor’s office, while hospital E&Ms are done in a hospital setting.