- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Contributor: Using Technology to Streamline Enrollment Into Available Medicare Subsidy Programs

Medicare Advantage plans can drive significant, sustainable, and scalable improvements to health outcomes; reduce cost; and boost retention and top-line revenue by enrolling beneficiaries into the comprehensive set of state and federal low-income programs available to them.

Approximately 32% of Medicare beneficiaries earn less than 150% of the Federal Poverty Level (FPL) and are eligible for at least 7 safety-net programs that help pay for critical necessities like health care and food. This financial support reduces the burdens of poverty, a key social determinant of health (SDOH) and CMS goal. These programs improve access to health care by reducing out-of-pocket medical expenses, greatly improving health outcomes.

Despite these enormous benefits, the underenrollment rate for Medicare beneficiaries is substantially higher than for the overall population due to low awareness, administrative burdens to apply, and barriers to staying enrolled. For example, just 33% of eligible Supplemental Nutrition Assistance Program (SNAP) beneficiaries 65 years and older are enrolled in the program. Even individuals enrolled in some programs are not enrolled in all the programs they are eligible for. Among families that received means-tested programs, 40% were enrolled in just 1 program and the average annual benefits received were $3000 out of a possible $9000.

Medicare Advantage (MA) plans are ideally positioned to solve this underenrollment problem. A total of 24 million people are enrolled in MA, comprising over one-third of all Medicare beneficiaries. MA plans have an incentive to help because enrollment improves health outcomes, reduces medical expenses, and makes health coverage more affordable. This gives MA plans a reason to sustainably scale their support, positioning MA as a powerful poverty reduction program.

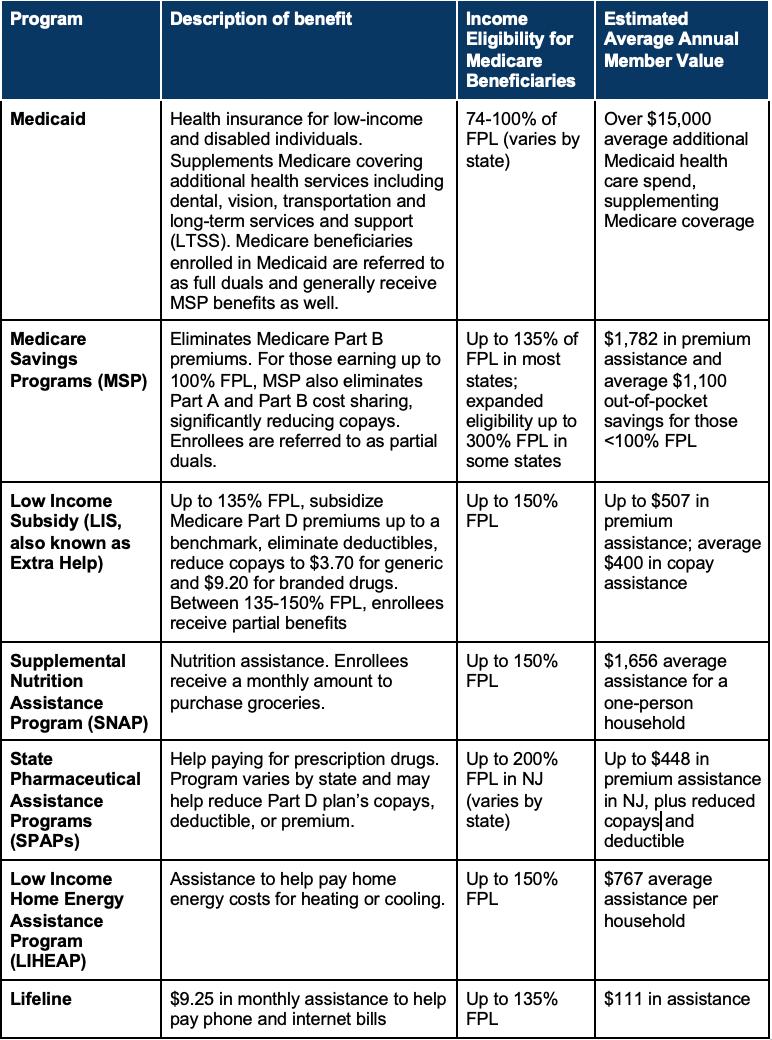

Safety-Net Programs Reduce Poverty and Improve Health Outcomes

Seven core safety-net programs (Exhibit) help the millions of households below 150% FPL afford basic needs. For example, Patricia D., a woman aged 73 years and an MA member in New York, earns $1250 per month from Social Security, putting her below 135% FPL. She was eligible for but not enrolled in the Medicare Savings Program (MSP), Low Income Subsidy (LIS), SNAP, and Lifeline because she was unaware of the programs. Enrollment eliminated her $148.50 monthly Medicare Part B premium and $42 monthly Part D premium as well as provided up to $204 per month in nutrition assistance and $9.25 per month for phone service. In total, Patricia D. reduced her direct monthly expenses by about 30% of her income.

Exhibit. Key State and Federal Government Programs for Low-Income Medicare Beneficiaries

By reducing out-of-pocket medical expenses and providing assistance for basic needs, these safety net programs not only ameliorate poverty but also improve health outcomes. Food and heating insecurity are major risk factors for health, and out-of-pocket medical expenses reduce access to health care.

Medicaid and MSP

Low-income Medicare beneficiaries spend over 30% of their income on out-of-pocket health care spending because, without supplemental insurance, Medicare has no out-of-pocket maximum and has 20% cost sharing (co-pays) for clinical services. Medicaid and MSP eliminate or reduce cost sharing for Medicare beneficiaries, increasing access to health care. Individuals just above 100% FPL, and therefore ineligible for these cost-sharing supports, incur an additional $1100 a year in out-of-pocket spending and utilize 55% fewer outpatient visits.

In addition, Medicaid covers services not covered by traditional Medicare including dental, vision, nonemergency transportation, and long-term services and supports (LTSS). There are 65% of Medicare beneficiaries living outside of a facility (referred to as “in the community”) that need at least some LTSS. For this population, Medicaid provides crucial support cost coverage.

LIS and SPAPs

LIS and state pharmaceutical assistance programs (SPAPs) eliminate or reduce co-pays and deductibles for prescriptions for Medicare beneficiaries. A 2021 Harvard and UC Berkeley research paper found that a $10 co-pay increase on prescription drugs causes a 23% decrease in total drug consumption and a 33% increase in mortality. LIS enrollees also have higher medication adherence for diabetes and hypertension medication compared with low-income nonenrollees.

SNAP

SNAP helps low-income households afford groceries. Among Medicare beneficiaries who received Medicaid, 33.6% reported food insecurity. Reducing hunger and food insecurity makes people healthier and reduces health care expenditures. Among an older Medicaid population, SNAP enrollment lowered the chance of nursing home admission by 23% and hospitalization by 14%; overall health care spending fell by $2100 per senior enrolled in SNAP.

Enrollment Into Duals Programs Addresses Inequalities in Health Care Financing

Low-income and food-insecure Medicare beneficiaries eligible but not enrolled in Medicaid or MSP are likely to have high medical expenses. The Medicare risk-adjustment model allocates more money to MA plans to reimburse for members with higher medical complexity but not social complexity. Dual status correlates with higher social complexity and health care spending, so CMS uses dual enrollment as an important variable in its model.

Until CMS updates its MA risk-adjustment models to incorporate social risk factors directly, dual status is the best way to ensure plans are reimbursed sufficiently to provide adequate services for these beneficiaries. Enrollment support optimizes appropriate designation of beneficiaries as having dual status and helps more equitably allocate Medicare dollars to low-income populations.

Enrollment Support Is a Win-Win for MA Plans and Their Members

A more equitable allocation of capitation payments is just one way in which MA plans and their members benefit from reducing underenrollment. MA plans have multiple overlapping incentives to encourage enrollment into additional programs, giving MA plans reason to sustainably scale their support.

Improve Member Health

Enrollment into government programs is linked to improved health and reduced hospitalization, as described above. MA plans are incentivized to improve member health because, given their fixed capitation payment, they save from reduced health care spend.

Improve Member Satisfaction and Reduce Plan Churn

Enrollment into government programs directly addresses members’ top concern of affordability by reducing out-of-pocket medical expenses, so MA plans that provide enrollment assistance can improve member satisfaction and CAHPS scores. Low-income Medicare beneficiaries spend about $4000 out-of-pocket on health care, or over 30% of their income. 8% of MA members voluntarily switch plans each year; among voluntary switchers, 25% cite a financial reason and 18% say they had trouble getting the plan to help pay for needed care.

Increase Part C Capitation

CMS pays a higher risk-adjusted Part C annual capitation for duals, providing more resources for the plan to pay for lower-income and disabled individuals’ medical costs. The increase in payment varies by diagnostic condition and demographics, but partial and full duals have risk scores 20% to 100% higher than their nondual counterparts.

Reduce Out-of-Pocket Pharmacy Costs and Increase Part D Revenue

For LIS and some SPAP enrollees, CMS and states pay Part D premiums up to a benchmark amount averaging approximately $35. Without this subsidy, many low-income individuals have to choose a MA plan with a $0 Part D premium. But LIS enrollees can select a plan with more generous drug coverage while saving about $400 in annual co-pays. MA plans that help members shift from a $0 Part D premium plan to a plan with a premium up to the benchmark help members while increasing Part D premiums.

More Cost-effective Than SDOH-Focused Supplemental Benefits

MA plans spend $29 per member per month on supplemental benefits to address SDOH and to grow plan membership, but many of the same benefits could be more efficiently and equitably provided by these existing programs. The most common supplemental benefits are also covered by Medicaid, including vision (75% of MA plans), hearing (70%), dental (70%), and transportation (35%). Recent rule changes have created a growing market for new kinds of supplemental benefits, including food assistance, home modifications, and OTC pharmacy assistance—benefits that overlap with SNAP, Medicaid, and SPAPs.

For the MA plan, supporting enrollment into safety-net programs is lower cost than directly providing supplemental benefits, and low-income members can often receive larger benefits from government programs. MA plans’ current supplemental benefit strategy risks creating a fractured social safety net. Instead, MA plans should prioritize enrollment support to build a more inclusive social safety net and make a bigger impact on members’ health and financial security.

Targeted Outreach and Simplified Applications Meaningfully Improve Enrollment

MA plans can learn from successful government and nonprofit pilot programs that have increased safety net program enrollment by addressing lack of awareness and administrative burdens through targeted outreach and case management support.

- Application assistance to SSI/SSDI for people experiencing homelessness boosted approval rates from 10% to 73%.

- Code for America, in partnership with Michigan HHS, simplified applicants’ online document submission, improving Medicaid approval rates from 53% to 71%.

- A cross-state policy comparison showed that higher awareness of health insurance options was one of the strongest predictors of applying, increasing the odds by 12%.

Conclusion

Throughout the pandemic, recertifications were paused for safety-net programs, swelling the number of enrollees. Medicaid enrollment was up 14% over the last 18 months. Soon, states and the Federal government will move to reassess enrollees’ eligibility. This backlog will create an influx of demand for enrollment support for MA plans. To ensure that individuals do not lose access to benefits they’re entitled to, MA plans must improve their enrollment support for low-income members.

Authors

Jeremy Rubel is a graduate of The Wharton School of the University of Pennsylvania. He previously worked at Uno Health and the Massachusetts Executive Office of Health and Human Services.

Anna de Paula Hanika is the CEO and Cofounder of Uno Health, founded in 2018. She previously worked at Clover Health, Sum, and Google and graduated from the University of Oxford with a Masters in Psychology and Neuroscience.

Andrey Ostrovsky, MD, FAAP, was the former chief medical officer of the US Medicaid program. He is the managing partner at Social Innovation Ventures where he invests in and advises companies and nonprofits dedicated to eliminating disparities. He also advises federal and state regulators on how to incorporate human-centered design into policy making. He previously operated a series of methadone clinics in Baltimore, Maryland. Prior to working on the front line of the opioid use disorder crisis, he served as the chief medical officer for the Center for Medicaid and CHIP Services, the nation’s largest health insurer, where he advocated to protect the program against several legislative efforts to significantly dismantle the program. He also led efforts to streamline Medicaid and make it more customer centric. Before leading the Medicaid program, he cofounded the software company, Care at Hand, an evidence-based predictive analytics platform that used insights of nonmedical staff to prevent aging people from being hospitalized. Care at Hand was acquired in 2016 by Mindoula Health. Before Care at Hand, Dr Ostrovsky led teams at the World Health Organization, US Senate, and San Francisco Health Department toward health system strengthening. Dr Ostrovsky has served on several boards and committees dedicated to behavioral health, interoperability standards, quality measurement, and home and community-based services including the National Academies of Medicine, National Quality Forum, Institute for Healthcare Improvement, and the Commonwealth Fund.