- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

Contributor: Top 3 Future Therapies to Drive Hemophilia Treatment Market Growth

The trends in the hemophilia treatment market are gaining momentum with increasing incidences of hemophilia A and B and staggering need for their treatments, including gene, anti-tissue factor pathway inhibitor, and factor replacement therapies.

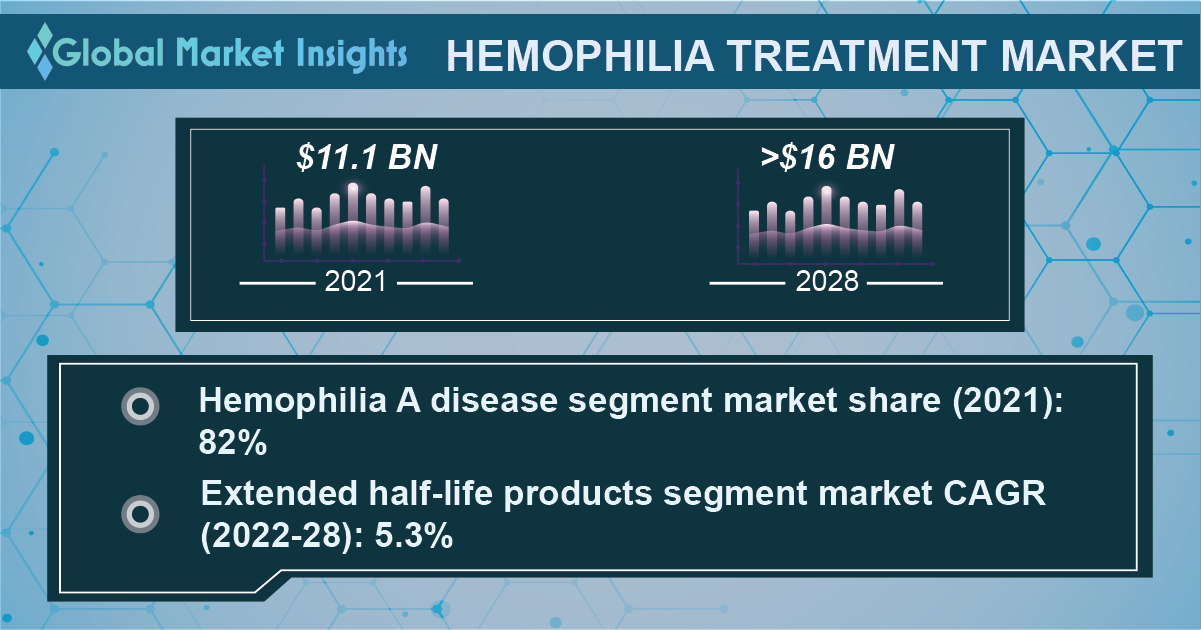

“With novel developments in hemophilia treatment progressing at an unprecedented pace, the industry is touted to seize an overall remuneration of USD 16 billion by 2028 end”- Global Market Insights Inc.

The trends in the hemophilia treatment market are gaining momentum with increasing incidences of hemophilia A and B and staggering need for their treatments (Figure). As per reliable estimates, the global prevalence of hemophilia A is announced to be approximately 1 case per 5000 males, with nearly 1 third of affected individuals not having a family history of the blood disorder. The rare disease frequency also varies with the reporting country, with a range of 5.4 to 14.5 cases per 100,000 males.

Figure

Hemophilia is a rare condition for which the approved treatment options have remained practically unchanged for quite a while now. Recently, however, the hemophilia treatment market is observing an explosion of innovation in the treatment options that are either under development or have already been approved, including some medications and injections.

In 2018, the FDA had approved emicizumab-kxwh which was intended to reduce or avert the frequency of bleeding episodes in people with hemophilia A. Some other options might include desmopressin, a manufactured hormone that stimulates the release of stored factor 8, and antifibrinolytic medications, that prevent clots from breaking down.

While oral medication and injections are recognized to treat the condition, its prolonged impact on human health or side effects are not known in detail. In this case, another welcome leap in the business space is the advancement in therapy options.

Given below are some of the latest advancements in the hemophilia treatment that are expected to push different economies toward healthy living and reduce the prevalence of the rare disease:

Gene Therapy

Since hemophilia is coined as a genetic disorder, gene therapy for its treatment could emerge as a ‘possible breakthrough’ in the health care fraternity. The treatment offers a potential cure for hemophilia patients by establishing constant endogenic expression of factor 8 or 9 following transmission of functional gene to swap the hemophilic patient’s own flawed gene.

While only about 25% to 30% of the world’s hemophilia population has access to factor replacement owing to its costly alternative, complications, and burden, the ability of gene therapy solution for hemophilia delivers hope for more global admittance to the treatment.

Having said that, results from one of the recent trials of the approach have been known to restore patients’ anticoagulant factor activity levels to near normal or normal levels and dropped down their annualized bleeding rates by almost 90%.

Anti-TFPI Therapy

Anti-tissue factor pathway inhibitor, or anti-TFPI, therapy is an advanced treatment that seeks to reduce bleeding by decreasing on the system that averts the blood from clotting too much. This therapy restores hemostatic balance by blocking one of the anticoagulants and preventing it from functioning normally.

Considering its success trail, different biopharmaceutical firms are now researching and analyzing ways to incorporate anti-TFPI therapy into their portfolio of hemophilia treatment. One of these companies is Pfizer.

The leading pharmaceutical firm recently announced dosing its first participant in the Phase 3 BASIS study of marstacimab, an anti-TFPI being evaluated for the treatment of people suffering from severe hemophilia A or B. The completed phase 2 study results represented that the treatment with marstacimab demonstrate more than 75% reductions in annual bleeding rates for almost all the participants in the study population.

Factor Replacement Therapy

The factor replacement therapy is deemed as one of the efficient therapies to treat hemophilia. In this, the clotting factors are injected into veins to stop severe blood loss and problems from bleeding such as joints, organs, and muscles. These therapies have been widely used before surgery or operation to avoid excessive blood loss.

According to a recent study by Global Market Insights Inc., it was revealed that the factor replacement therapy surpassed USD 9,412 million in 2021, in terms of valuation, across the overall industry. It is further anticipated to hold a prominent position worldwide owing to the ongoing R&Ds and advancements in the space.

To illustrate, the US FDA announced approval of Factor VII treatment for hemophilia A and B with inhibitors.

In a nutshell, increasing prevalence of hemophilia and surging need for associated treatment therapies globally would help hemophilia treatment market growth curve to ascend significantly through 2028.

Reference

Hemophilia treatment market size by disease (hemophilia a {severe, moderate, mild}, hemophilia b {severe, moderate, mild}), by product (recombinant factor concentrates {factor VIII, factor IX}, plasma-derived factor concentrates {factor VIII, factor IX}, extended half-life products {factor VIII, factor IX}), by patient (pediatric {0 to 4, 5 to 13, 14 to 18}, adult {19 to 44, 45+}), by treatment (prophylaxis, on demand), by therapy (factor replacement therapy, non-factor replacement therapy), by drug class (vasopressin, coagulation factors), by route of administration (injectable, nasal spray), by end-use (hospitals, clinics, hemophilia treatment centers), industry analysis report, regional outlook, application potential, COVID-19 impact analysis, price trends, competitive market share & forecast, 2022 – 2028. Global Markets Insights website. gminsights.com/industry-analysis/hemophilia-treatment-market. Publication February 2022. Accessed April 2022.

ICYMI: Highlights From the 2022 American Academy of Dermatology Meeting

December 17th 2022This American Academy of Dermatology (AAD) Annual Meeting covered a breakthrough therapy for the management of vitiligo, clinical and epidemiological differences of certain dermatologic diseases, and the role of dietary triggers on patient outcomes.

Read More

Method of Tissue Acquisition May Determine Success of Gene Sequencing in Lung Cancer

July 7th 2022Successful comprehensive genomic profiling of tissue samples among patients with lung cancer was more likely to occur when samples were extracted via resections vs fluid cytology, biopsy, or fine-needle aspirations.

Read More

FOENIX Update: A New Era in Cholangiocarcinoma Precision Medicine

July 1st 2022Patients with iCCA, particularly those whose disease progresses following first-line chemotherapy, have limited overall treatment options. Data presented at the 2022 American Society of Clinical Oncology (ASCO) Annual Meeting show that patients may soon have a new agent to fight this rare cancer in futibatinib (Taiho Oncology), an FGFR inhibitor.

Read More

Lack of CGP Testing May Result in Missed Therapy Options in NSCLC

June 28th 2022A real-world analysis found that comprehensive genomic profiling (CGP) in patients with non–small cell lung cancer (NSCLC) increases their therapy options patients and CGP testing needs to be utilized more.

Read More