- Center on Health Equity & Access

- Clinical

- Health Care Cost

- Health Care Delivery

- Insurance

- Policy

- Technology

- Value-Based Care

CJR Voluntary Participation—Should I Stay or Should I Go?

This article focuses on the financial results that may accrue to a participating hospital throughout the remainder of the Comprehensive Care for Joint Replacement program as a result of the migration from historical baseline to regional target rates, and rebasing of the historical baseline.

This article was co-authored by Jonathan Pearce, CPA, FHFMA, principal, Singletrack Analytics.

CMS finalized its proposal to allow about half of the hospitals in the Comprehensive Care for Joint Replacement (CJR) program to discontinue participation beginning January 2018. Now hospitals in the voluntary Metropolitan Statistical Areas (MSAs) are scrambling to decide whether to leave the program or continue to participate. Many factors are involved in this decision, including investment in infrastructure, care management processes, and physician and leadership engagement. This article focuses on the financial results that may accrue to a participating hospital throughout the remainder of the CJR program as a result of the migration from historical baseline to regional target rates, and rebasing of the historical baseline.

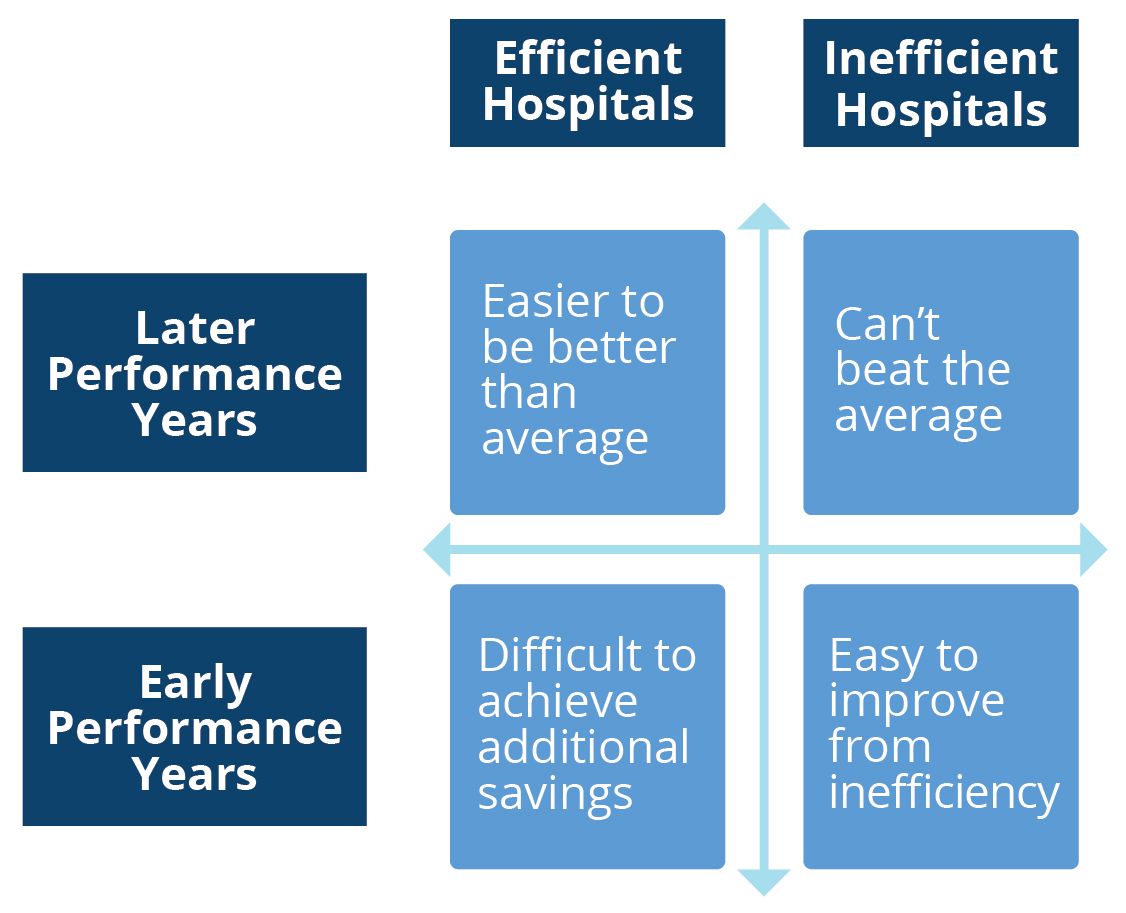

Winners and Losers at Different Times

Financial success in the CJR program occurs in 2 ways, depending on the performance year. In the first 2 performance years, the episode financial targets are derived primarily from the hospital’s cost during the initial baseline period (2012-2014), while in the last 3 years of the program, the financial targets are derived primarily from the average episode costs of other hospitals in the same geographic region. Therefore, hospitals whose use of postacute services is generally inefficient (postacute cost exceeding 50% of the total episode cost) have high baseline costs and correspondingly high targets, and may have greater opportunities to reduce the postacute cost and achieve savings during those periods. However, during the last 3 years of the program, targets are increasingly or entirely derived from the regional average costs, which are often significantly lower than an inefficient hospital’s baseline cost. Unless inefficient hospitals have significantly reduced postacute cost during the early years of CJR, they may find the transition to regional targets will reverse any previous surpluses and will instead generate losses in the last 3 years of the program.

Conversely, hospitals that already have low postacute costs (postacute costs less than 40% of the total episode cost) may have low baseline costs, and therefore may have found it difficult to achieve savings in the early years of the program. However, after the transition to regional rates in year 4, they may find their targets increasing and thus may create surpluses in later years when none were possible during the earlier performance periods. In many cases, a successful CJR strategy has been to simply wait out the changes to the target and expect performance to improve when the regional rates kick in.

Regional Targets Alter the Success Landscape

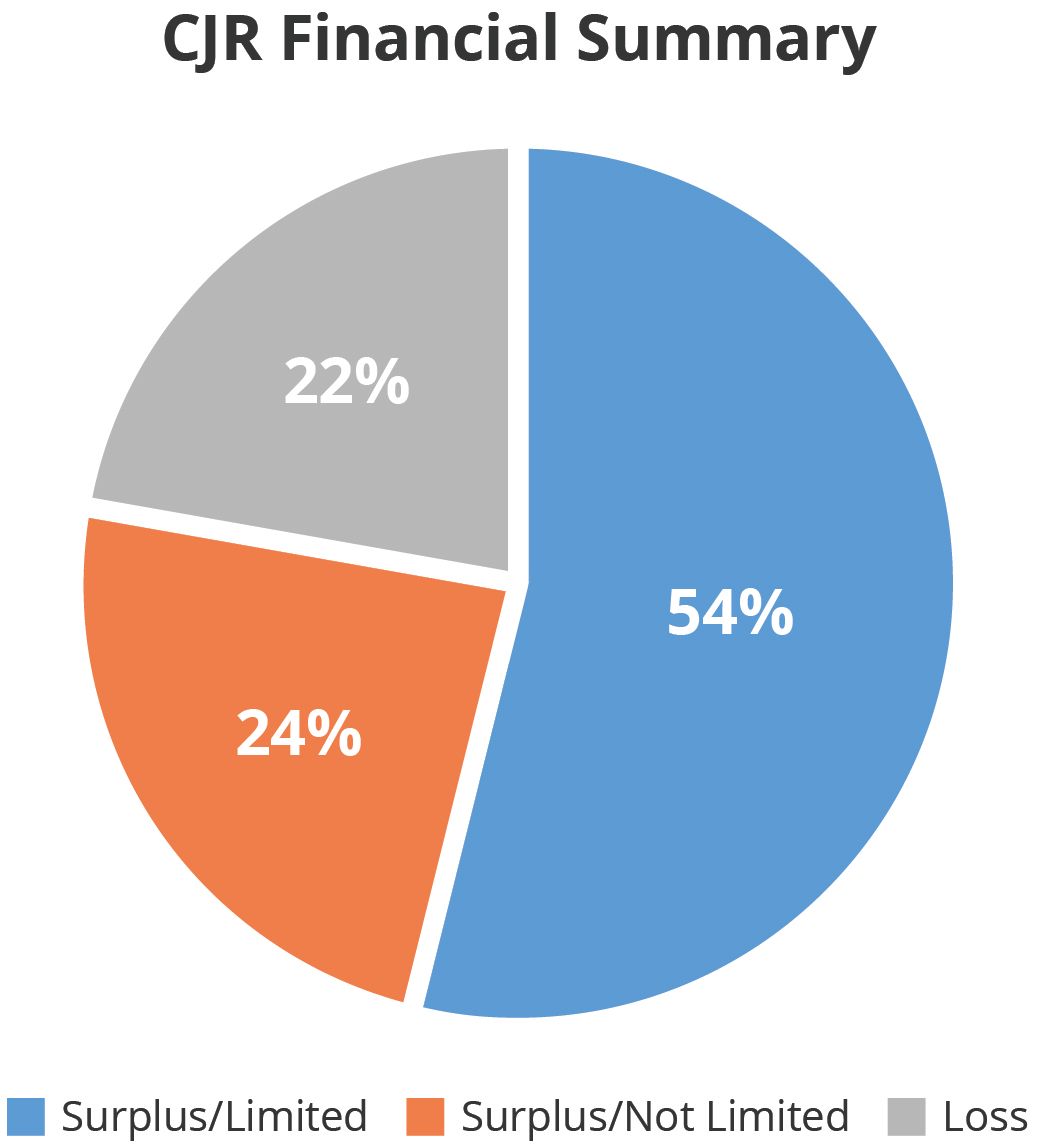

Under the blend of historical and baseline targets used in the first CJR performance year (PY1), any hospital that reduced its episode cost by more than the discount percentage was able to achieve a financial surplus. Apparently, many hospitals were able to implement these types of changes. More than 75% of our client hospitals achieved a surplus and more than half achieved a surplus that exceeded the PY1 stop-gain limit. Less than 25% incurred losses.

The situation will dramatically change, however, when targets become based on regional averages. Those hospitals with episode costs below the average of the region (not their own historical cost) will incur surpluses, while those with costs above the regional average will incur deficits. Thus, while a large proportion of CJR participants may be creating savings based on baseline-derived targets, many will lose money when regional targets are implemented simply because of the use of regional data rather than the hospitals’ historical data. The entire financial dynamic has been upended.

Projecting Future Performance

Because of this change in the derivation of the targets, past performance is definitely not indicative of future financial results. Therefore, it will be important for hospitals considering continuing participation in CJR to model their performance using the regional target rates.

An example of this analysis for 2 hospitals is shown below (the numbers have been changed slightly to maintain confidentiality). This table shows the following metrics for Diagnosis Related Group 470 non-fracture episodes:

- The PY1 target amount per episode and the regional target amount per episode

- The PY1 total episode cost

- The PY1 total target amount and the regional total target amount

- The PY1 net program reimbursement amount and the surplus or deficit that would result from applying the PY1 episode cost to the regional target amount

- The percentage change from the PY1 (hospital-specific) target to the PY4 (regional) target

Metric

Efficient Hospital A

Inefficient Hospital B

Episode Count

275

40

PY1 Target per Episode

$23,050

$43,700

Total Episode Cost

$5,745,000

$1,902,000

PY1 Total Target

$6,320,000

$1,830,000

PY1 NPRA

$575,000

-$72,000

PY4 Target per Episode

$24,050

$39,900

PY4 Target

$6,580,000

$1,674,000

PY4 NPRA

$835,000

$-228,000

Target Percent Change

4%

-9%

NPRA indicates net program reimbursement amount; PY, performance year.

Hospital A was relatively cost-efficient at the start of the CJR program and managed to moderately reduce episode costs in PY1, achieving a surplus of $575,000. Because it was more cost-efficient than other hospitals in the region during the baseline period, the PY1 target is $1000 lower than the PY4 target that will be implemented in the later years of CJR. Applying the PY4 target to its episode cost during PY1 would create a surplus of $835,000. This hospital will probably elect to remain in the CJR program.

Alternatively, Hospital B had significantly higher costs during PY1 than other hospitals within its region. It was able to slightly reduce its episode cost during that period, achieving a savings of $72,000. However, the PY4 target is significantly lower than the PY1 target; therefore, the transition to regional rates would create significant losses. This hospital will probably elect to leave the CJR program even though its initial financial results were moderately positive.

Conclusions

As described above, the landscape for CJR-participating hospitals will dramatically change throughout the performance period. Hospitals should understand how these changes in the derivation of targets will affect their financial results—and that past performance may not be indicative of future results. Hospitals in voluntary MSAs need to understand the effects of the changes in the financial structure of the CJR program to make an informed participation decision. Hospitals in mandatory MSAs should likewise prepare themselves for the effects of these changes.

NAACOS Continues Pushing Forward on the Transition to Value-Based Care

September 21st 2020Allison Brennan, MPP, discusses legislation that would affect accountable care organizations (ACOs), the impact coronavirus disease 2019 had on ACOs, and the fall National Association of ACOs meeting.

Listen

Examining Physician-Initiated Alternative Payment Models, a New Wave of Payment Reform

September 12th 2019To date, most alternative payment models (APMs) that have emerged in the shift toward value-based care have been initiated by payers and focused on primary care providers. However, there has recently been a new wave of payment reform in which providers, mostly specialists, are designing and implementing their own APMs in their practices. A study published in the September issue of The American Journal of Managed Care® analyzed some of these new payment models to gain insight into what providers are prioritizing in their APMs.

Listen